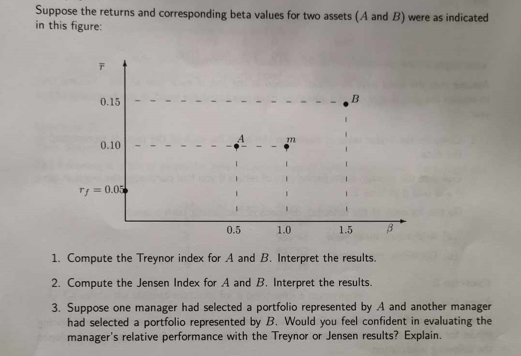

Question: Suppose the returns and corresponding beta values for two assets ( ( A ) and ( B ) ) were as indicated in this figure:

Suppose the returns and corresponding beta values for two assets ( \\( A \\) and \\( B \\) ) were as indicated in this figure: 1. Compute the Treynor index for \\( A \\) and \\( B \\). Interpret the results. 2. Compute the Jensen Index for \\( A \\) and \\( B \\). Interpret the results. 3. Suppose one manager had selected a portfolio represented by \\( A \\) and another manager had selected a portfolio represented by \\( B \\). Would you feel confident in evaluating the manager's relative performance with the Treynor or Jensen results? Explain

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts