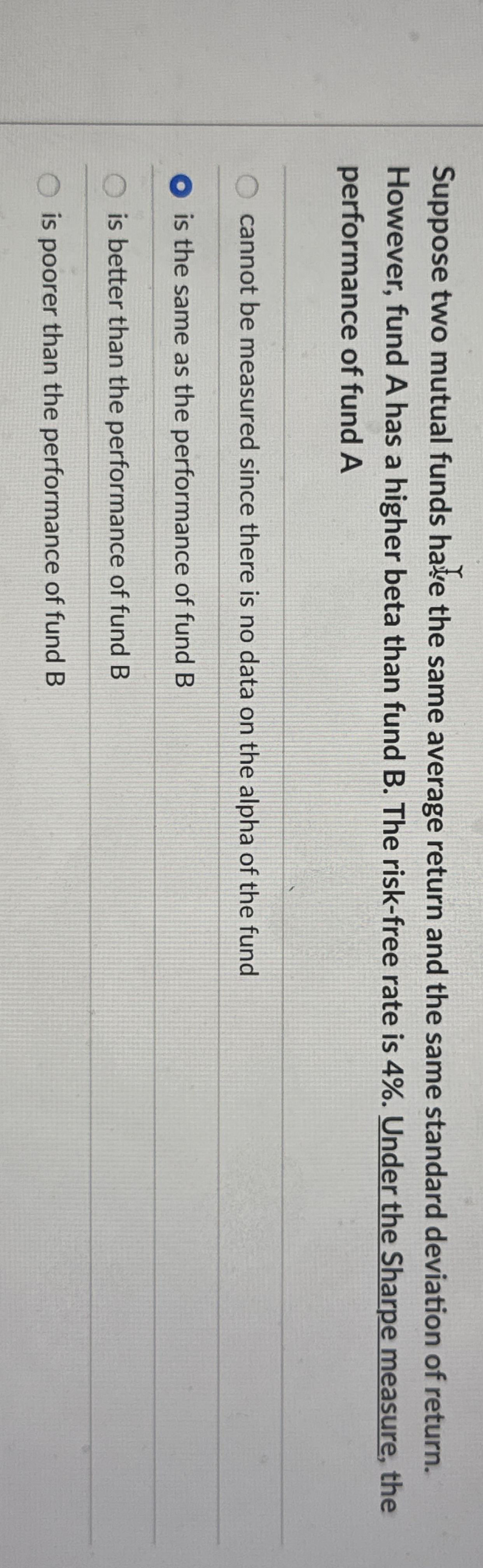

Question: Suppose two mutual funds hate the same average return and the same standard deviation of return. However, fund A has a higher beta than fund

Suppose two mutual funds hate the same average return and the same standard deviation of return.

However, fund A has a higher beta than fund B The riskfree rate is Under the Sharpe measure, the

performance of fund

cannot be measured since there is no data on the alpha of the fund

is the same as the performance of fund B

is better than the performance of fund B

is poorer than the performance of fund

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock