Question: Table Pidate Chip Chant TEXT Box Mb Page Number AS Drop Cap Tables Illustrations Heider & Footer Text 1. Last year, the Brown Bike Co.

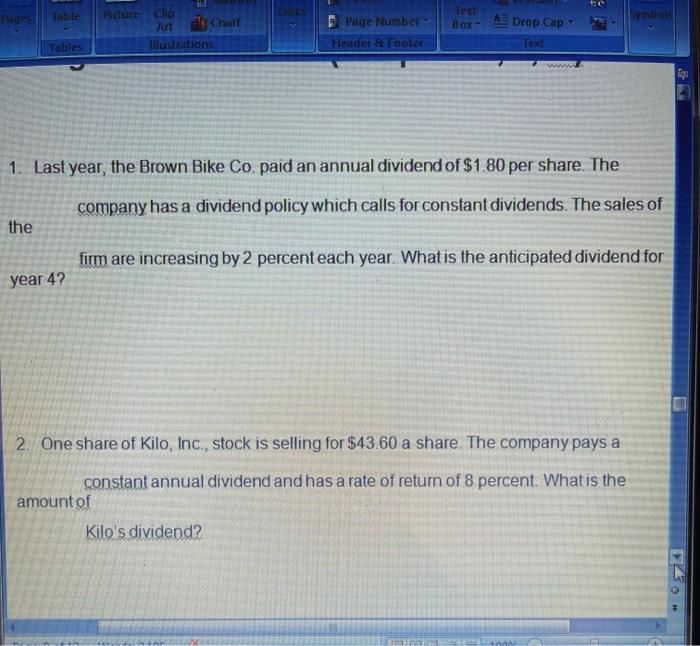

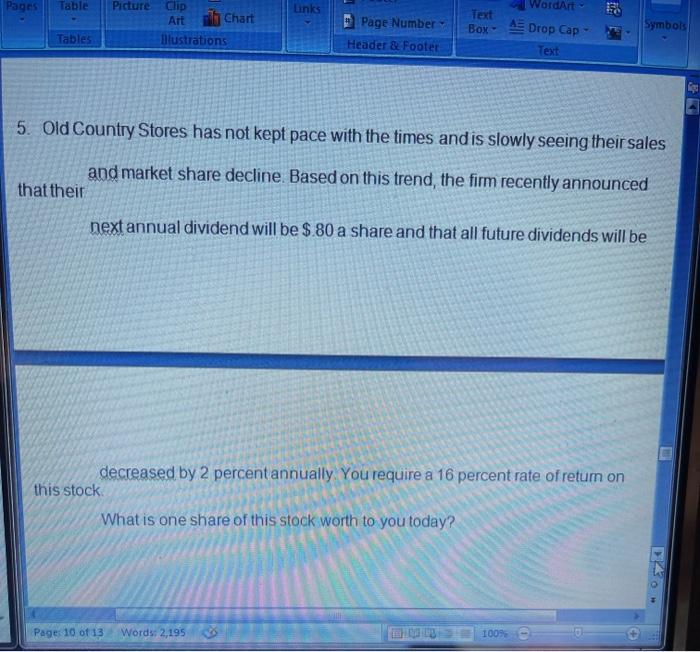

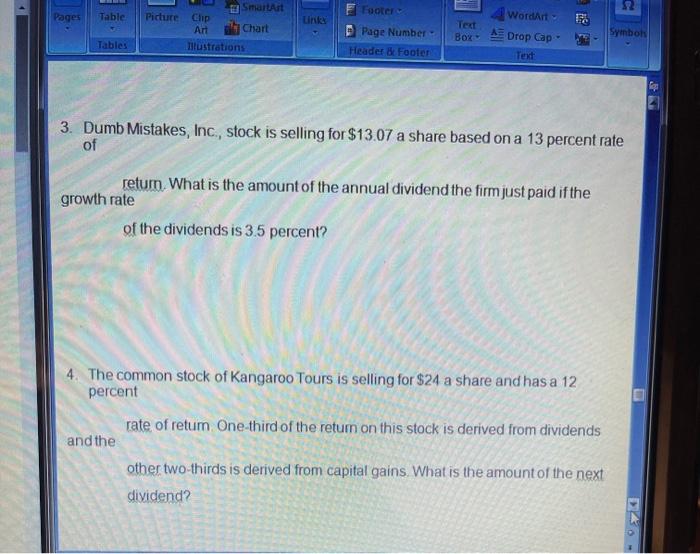

Table Pidate Chip Chant TEXT Box Mb Page Number AS Drop Cap Tables Illustrations Heider & Footer Text 1. Last year, the Brown Bike Co. paid an annual dividend of $1.80 per share. The company has a dividend policy which calls for constant dividends. The sales of the fimm are increasing by 2 percent each year. What is the anticipated dividend for year 4? 2. One share of Kilo, Inc., stock is selling for $43.60 a share. The company pays a constant annual dividend and has a rate of retum of 8 percent. What is the amount of Kilo's dividenda Pages Table Links WordArt Picture Clip Art Chart Illustrations Text Box A Drop Cap Symbols Tables Page Number Header & Footer Text 5. Old Country Stores has not kept pace with the times and is slowly seeing their sales and market share decline Based on this trend, the firm recently announced that their next annual dividend will be $.80 a share and that all future dividends will be decreased by 2 percent annually You require a 16 percent rate of return on this stock What is one share of this stock worth to you today? "A Page 10 of 13 Words: 2,195 BD 100% SmartArt 22 Pages Table Picture Clip Art Unik WordArt - Chart Footer P Page Number Header 8 Footer Box A Drop Cap Symboh Tables Illustrations Text 3. Dumb Mistakes, Inc., stock is selling for $13.07 a share based on a 13 percent rate of retum. What is the amount of the annual dividend the firm just paid if the growth rate of the dividends is 3.5 percent? 4. The common stock of Kangaroo Tours is selling for $24 a share and has a 12 percent rate of retum One-third of the return on this stock is derived from dividends and the other two-thirds is derived from capital gains. What is the amount of the next dividend

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts