Question: = Taxable income Path:p >> span Words 2 QUESTION 14 Steven, age 35 and single, is a commodities broker. His salary for 2019 is $111,500

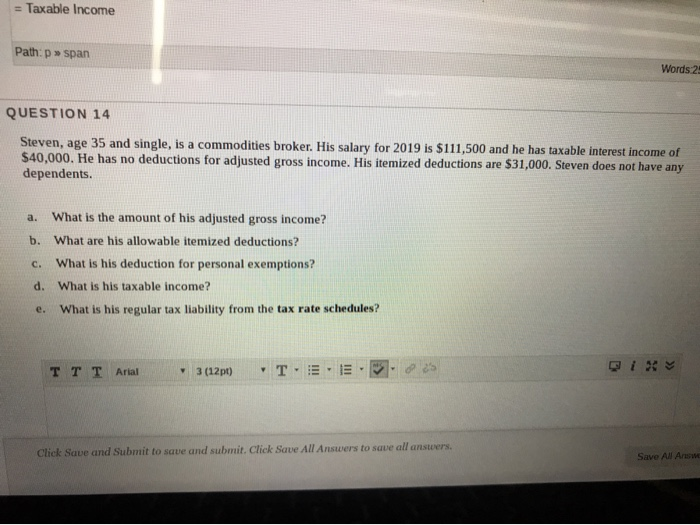

= Taxable income Path:p >> span Words 2 QUESTION 14 Steven, age 35 and single, is a commodities broker. His salary for 2019 is $111,500 and he has taxable interest income of $40,000. He has no deductions for adjusted gross income. His itemized deductions are $31,000. Steven does not have any dependents. a. b. c. What is the amount of his adjusted gross income? What are his allowable itemized deductions? What is his deduction for personal exemptions? What is his taxable income? What is his regular tax liability from the tax rate schedules? d. e. TT T Arial 3 (12pt) TE Click Save and Submit to save and submit. Click Save All Answers to save all answers. Save All Are

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts