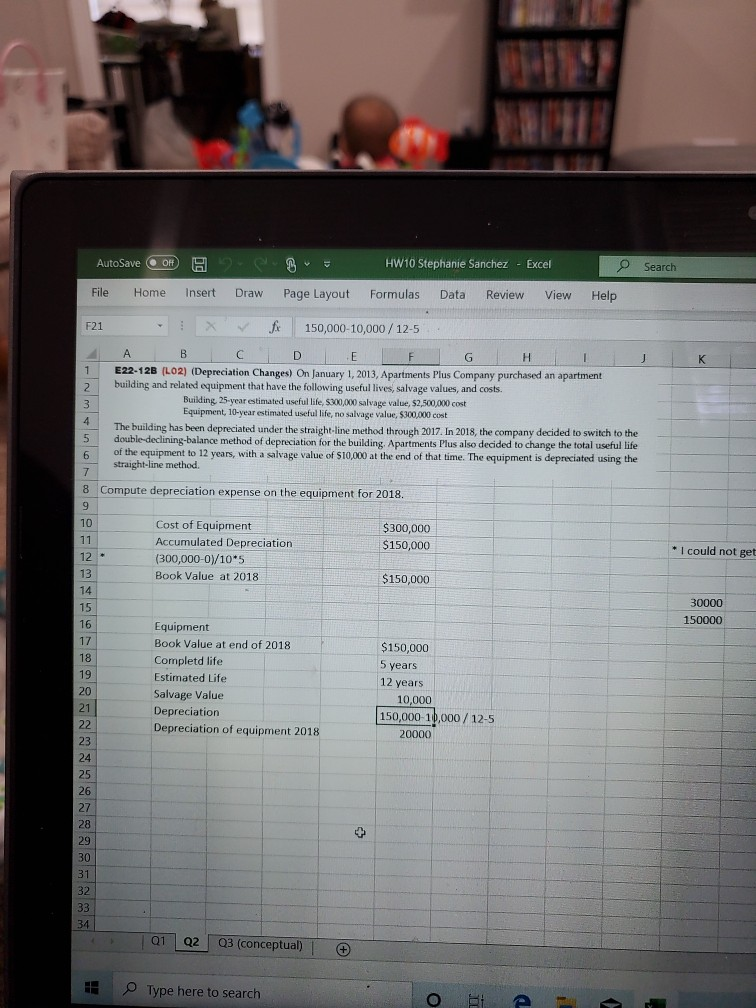

Question: That is the answer i got but i did 5 years and i tjink i should have done 4 ....i just want to know is

That is the answer i got but i did 5 years and i tjink i should have done 4 ....i just want to know is this correct or wrong before i turn it in

Search AutoSave Of H9 File Home Insert B Draw H W 10 Stephanie Sanchez - Excel Formulas Data Review View Page Layout Help F21 4 27 fx 150,000-10,000/12-5 A B C D E F G H I J E22-12B (L02) (Depreciation Changes) On January 1, 2013, Apartments Plus Company purchased an apartment building and related equipment that have the following useful lives, salvage values, and costs. Building 25-year estimated useful life, 5300,000 salvage value, $2,500,000 cost Equipment, 10-year estimated useful life, no salvage value, $300,000 cost The building has been depreciated under the straight-line method through 2017. In 2018, the company decided to switch to the double-declining-balance method of depreciation for the building, Apartments Plus also decided to change the total useful life of the equipment to 12 years, with a salvage value of $10,000 at the end of that time. The equipment is depreciated using the straight-line method 5 6 8 Compute depreciation expense on the equipment for 2018. 9 10 Cost of Equipment $300,000 Accumulated Depreciation $150,000 (300,000-0)/10*5 Book Value at 2018 $150,000 * I could not get 30000 150000 Equipment Book Value at end of 2018 Completd life Estimated Life Salvage Value Depreciation Depreciation of equipment 2018 $150,000 5 years 12 years 10,000 150,000 10,000 / 12-5 20000 Q1 Q2 Q3 (conceptual) Type here to search o te

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts