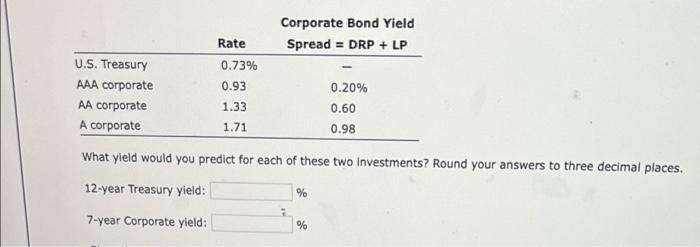

Question: thats all Corporate Bond Yield Rate Spread = DRP + LP U.S. Treasury 0.73% AAA corporate 0.93 0.20% AA corporate 1.33 0.60 A corporate 1.71

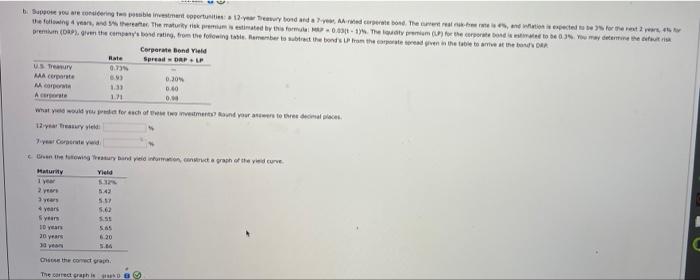

Corporate Bond Yield Rate Spread = DRP + LP U.S. Treasury 0.73% AAA corporate 0.93 0.20% AA corporate 1.33 0.60 A corporate 1.71 0.98 What yield would you predict for each of these two investments? Round your answers to three decimal places. 12-year Treasury yield: % 7-year Corporate yield: % bi se you are concering terbenestar oportunities 17 www hond and Medcover the tree. Wat is eerste the flyers, there the maturity is primestimated by the format 0-1. They the corporate Bond may determine the ti premium (DP) the condities, from the following the menter to be the bonds From the contender the tree to the DAR Corporate Bond Yield Rate Spread DRPLP USTRY . MA corante 0.30 Morp 1.31 0.40 Acerat 0. what would you for each of tweets and your towe do 12 years wie yer Corporated how her bir elmondtagram of the yed curve Maturity Yield 1 year 12 2 year 14 5.17 4 years 5.60 years 555 ID yan SAS 20 years 620 the correcta The correct graphi DB

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts