Question: The Al-Majid Construction Management Company constructs and operates different communities in certain parts of UAE. The past few years have been difficult ones for

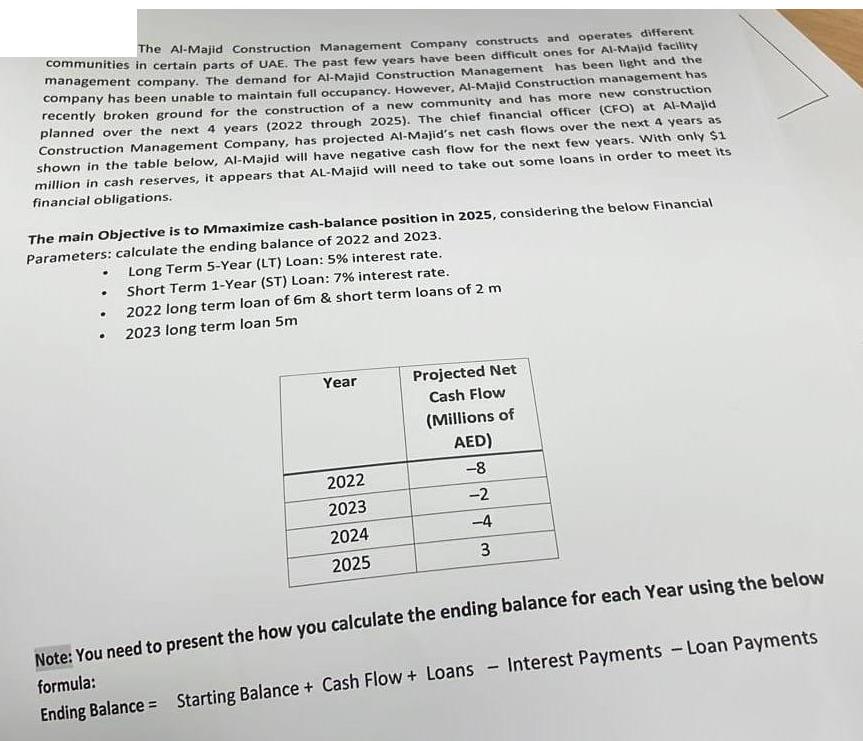

The Al-Majid Construction Management Company constructs and operates different communities in certain parts of UAE. The past few years have been difficult ones for Al-Majid facility management company. The demand for Al-Majid Construction Management has been light and the company has been unable to maintain full occupancy. However, Al-Majid Construction management has recently broken ground for the construction of a new community and has more new construction planned over the next 4 years (2022 through 2025). The chief financial officer (CFO) at Al-Majid Construction Management Company, has projected Al-Majid's net cash flows over the next 4 years as shown in the table below, Al-Majid will have negative cash flow for the next few years. With only $1 million in cash reserves, it appears that AL-Majid will need to take out some loans in order to meet its financial obligations. The main objective is to Mmaximize cash-balance position in 2025, considering the below Financial Parameters: calculate the ending balance of 2022 and 2023. . . . Long Term 5-Year (LT) Loan: 5% interest rate. Short Term 1-Year (ST) Loan: 7% interest rate. 2022 long term loan of 6m & short term loans of 2 m 2023 long term loan 5m Year 2022 2023 2024 2025 Projected Net Cash Flow (Millions of AED) -8 -2 -4 3 Note: You need to present the how you calculate the ending balance for each Year using the below formula: Ending Balance Starting Balance + Cash Flow + Loans Interest Payments - Loan Payments

Step by Step Solution

3.54 Rating (157 Votes )

There are 3 Steps involved in it

To calculate the ending balance for each year 2022 and 2023 while considering the provided financial parameters you can use the following formula Endi... View full answer

Get step-by-step solutions from verified subject matter experts