Question: The Homestretch Corporation has been using their current network system for 2 years and it originally cost $395,000. The system is being depreciated using the

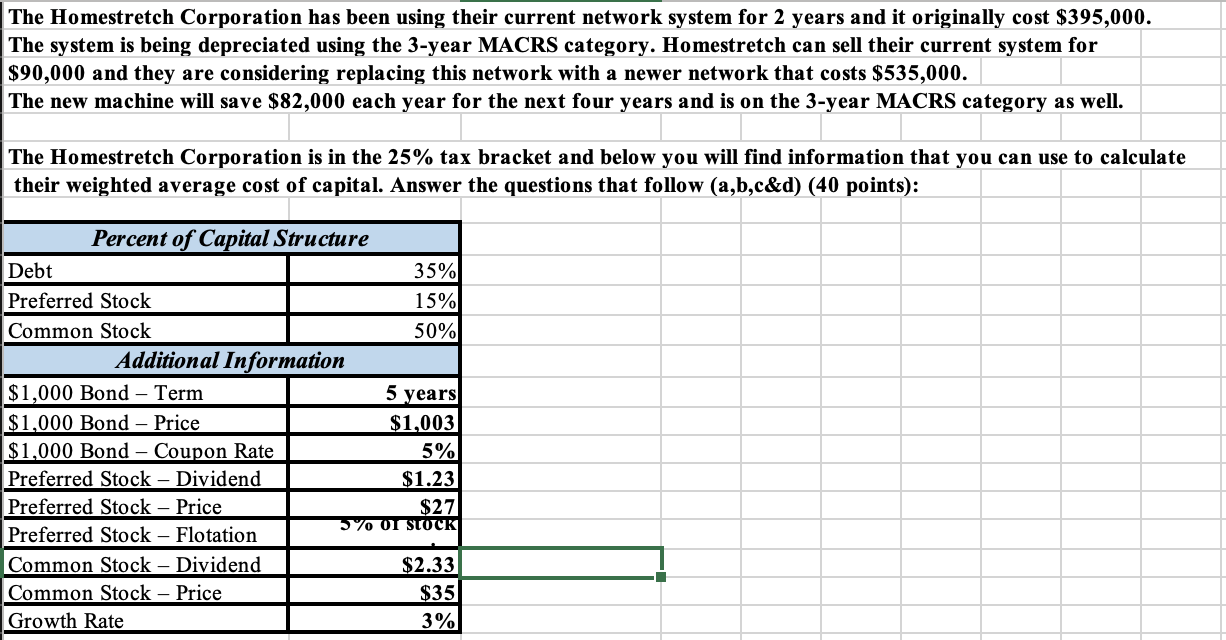

The Homestretch Corporation has been using their current network system for 2 years and it originally cost $395,000. The system is being depreciated using the 3-year MACRS category. Homestretch can sell their current system for $90,000 and they are considering replacing this network with a newer network that costs $535,000. The new machine will save $82,000 each year for the next four years and is on the 3-year MACRS category as well. The Homestretch Corporation is in the 25% tax bracket and below you will find information that you can use to calculate their weighted average cost of capital. Answer the questions that follow (a,b,c&d) (40 points): Percent of Capital Structure Debt 35% Preferred Stock 15% Common Stock 50% Additional Information $1,000 Bond - Term 5 years $1,000 Bond - Price $1,003 $1,000 Bond - Coupon Rate 5% Preferred Stock - Dividend $1.23 Preferred Stock - Price $27 400T STOCK Preferred Stock - Flotation Common Stock - Dividend $2.33 Common Stock - Price $35 Growth Rate 3% The Homestretch Corporation has been using their current network system for 2 years and it originally cost $395,000. The system is being depreciated using the 3-year MACRS category. Homestretch can sell their current system for $90,000 and they are considering replacing this network with a newer network that costs $535,000. The new machine will save $82,000 each year for the next four years and is on the 3-year MACRS category as well. The Homestretch Corporation is in the 25% tax bracket and below you will find information that you can use to calculate their weighted average cost of capital. Answer the questions that follow (a,b,c&d) (40 points): Percent of Capital Structure Debt 35% Preferred Stock 15% Common Stock 50% Additional Information $1,000 Bond - Term 5 years $1,000 Bond - Price $1,003 $1,000 Bond - Coupon Rate 5% Preferred Stock - Dividend $1.23 Preferred Stock - Price $27 400T STOCK Preferred Stock - Flotation Common Stock - Dividend $2.33 Common Stock - Price $35 Growth Rate 3%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts