Question: The is Problem Solving. MUST Show INPUT and OUTPUT of Each Financial Function Key. All the answers are expressed at 2 digits after the decimal

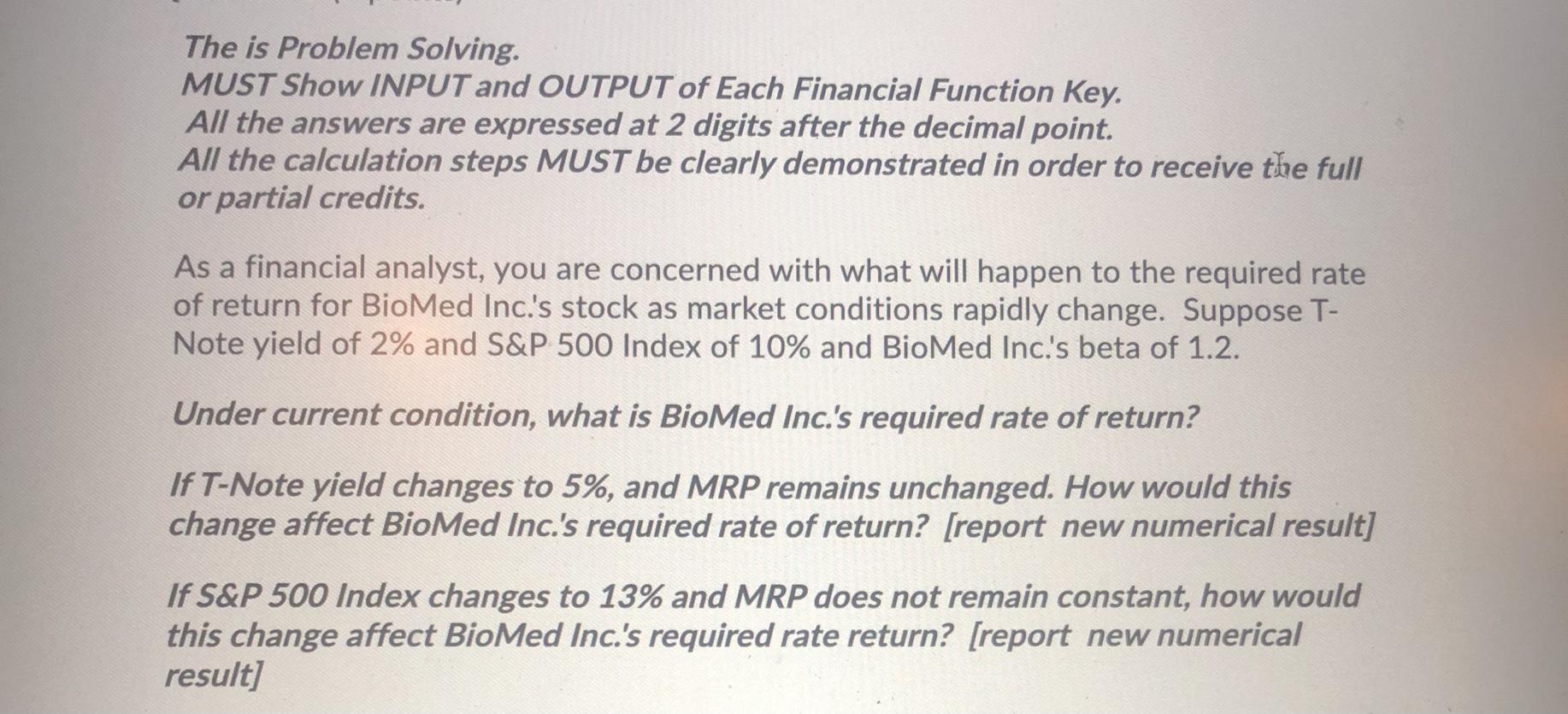

The is Problem Solving. MUST Show INPUT and OUTPUT of Each Financial Function Key. All the answers are expressed at 2 digits after the decimal point. All the calculation steps MUST be clearly demonstrated in order to receive the full or partial credits. As a financial analyst, you are concerned with what will happen to the required rate of return for BioMed Inc.'s stock as market conditions rapidly change. Suppose T- Note yield of 2% and S&P 500 Index of 10% and BioMed Inc.'s beta of 1.2. Under current condition, what is BioMed Inc.'s required rate of return? If T-Note yield changes to 5%, and MRP remains unchanged. How would this change affect BioMed Inc.'s required rate of return? [report new numerical result] If S&P 500 Index changes to 13% and MRP does not remain constant, how would this change affect BioMed Inc.'s required rate return? [report new numerical result]

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts