Question: The Lumber Yard is considering adding a new product line that is expected to increase annual sales by $277,000 and expenses by $184,000. The project

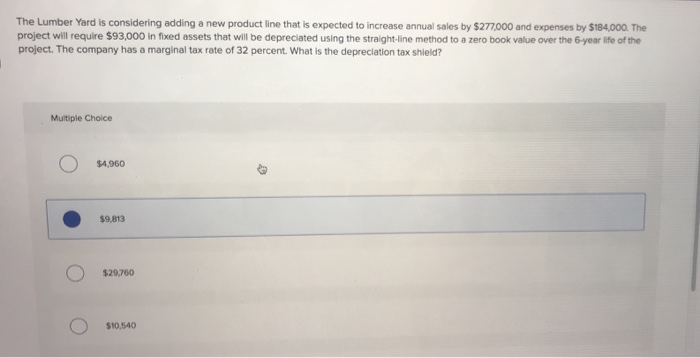

The Lumber Yard is considering adding a new product line that is expected to increase annual sales by $277,000 and expenses by $184,000. The project will require $93,000 in fixed assets that will be depreciated using the straight line method to a zero book value over the 6-year life of the project. The company has a marginal tax rate of 32 percent. What is the depreciation tax shield? Multiple Choice O $4,960 $9,813 O $20,760 O $10.540

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts