Question: the output from a linear regression model, and one implication of the regression output is that the bid-ask spread for NASDAQ-listed stocks declines by nearly

the output from a linear regression model, and one implication of the regression output is that the bid-ask spread for NASDAQ-listed stocks declines by nearly one-half cent per share if the trading volume increases by 10%. Does is make sense that there should be a negative relationship between the bid-ask spread and trading volume? Suppose volume increases by 25% on one day due to market news. What is the expect impact of this volume shift on the bid-ask spread? Please explain your responses.

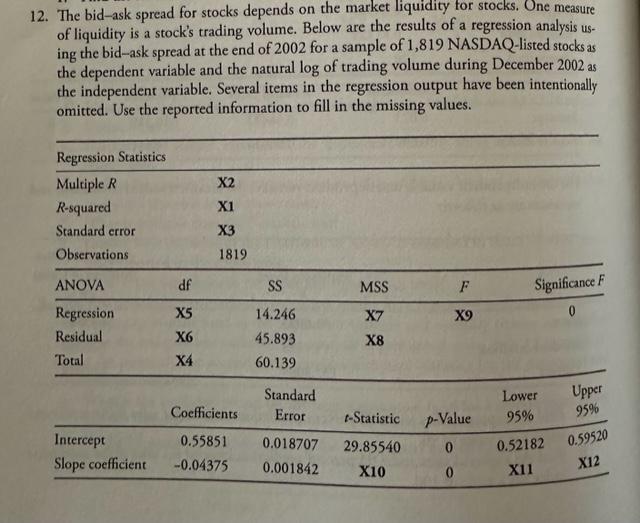

2. The bid-ask spread for stocks depends on the market liquidity for stocks. One measure of liquidity is a stock's trading volume. Below are the results of a regression analysis ustw..chakid a sele enread ar the end of 2002 for a sample of 1,819 NASDAQ-listed stocks as 2. The bid-ask spread for stocks depends on the market liquidity for stocks. One measure of liquidity is a stock's trading volume. Below are the results of a regression analysis ustw..chakid a sele enread ar the end of 2002 for a sample of 1,819 NASDAQ-listed stocks as

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts