Question: The table below (Table 8.9, BMA) shows the correlation between returns of 7 different stocks. How likely is it that an equally weighted portfolio of

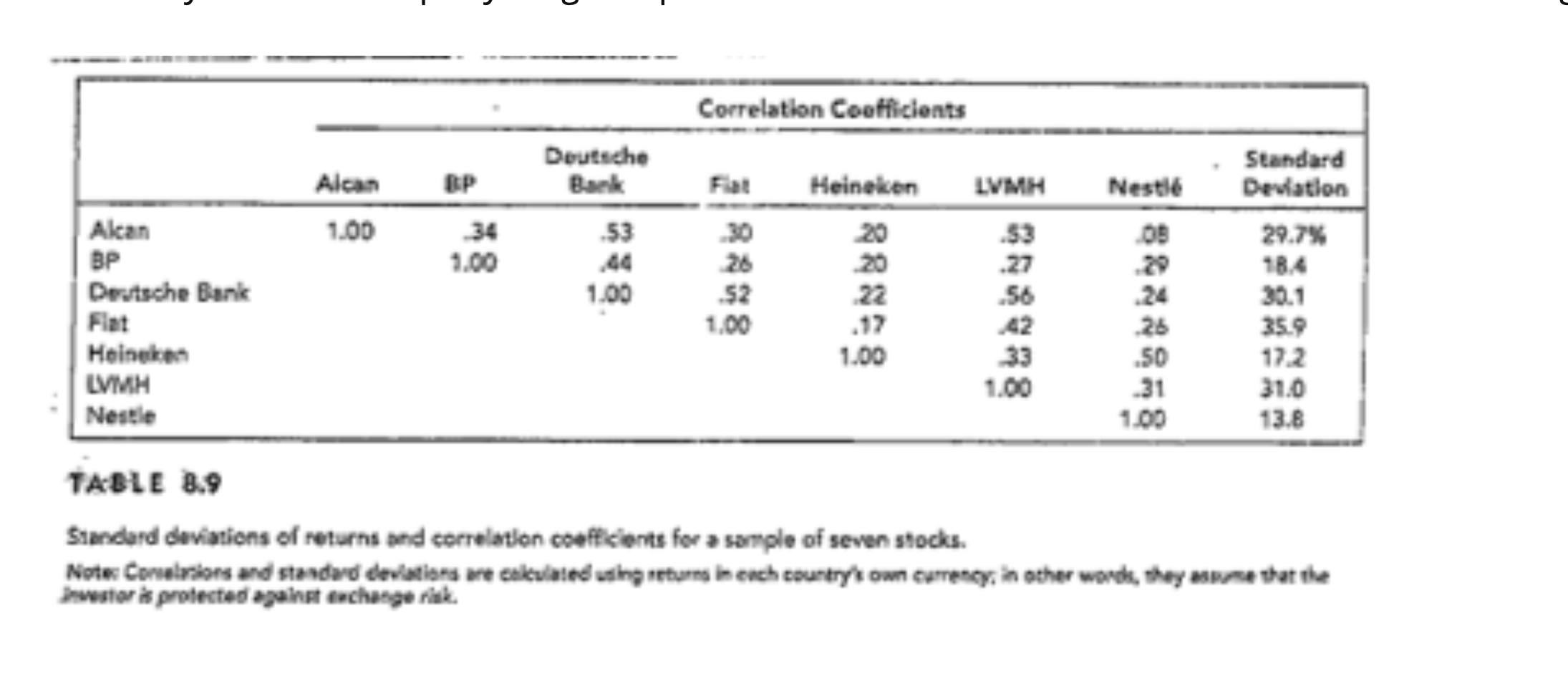

The table below (Table 8.9, BMA) shows the correlation between returns of 7 different stocks. How likely is it that an equally weighted portfolio of the 7 stocks has a standard deviation exceeding 25%? Explain.

The table below (Table 8.9, BMA) shows the correlation between returns of 7 different stocks. How likely is it that an equally weighted portfolio of the 7 stocks has a standard deviation exceeding 25%? Explain.

Correlation Coofficients BP Deutsche Bank .53 Heineken LVMH Nestle Standard Deviation Alcan 1.00 53 03 29.7% 1.00 .27 1.00 .56 Alcan BP Deutsche Bank Fiat Heineken LVIMH Nestle 52 1.00 20 22 .17 1.00 42 33 26 .50 31 1.00 35.9 17.2 31.0 13.8 1.00 TABLE 8.9 Standard deviations of returns and correlation coefficients for a sample of seven stocks. Note Contains and standard deviations we calculated using returns in each country's own currency in other words, they are that the Inwestors protected against exchange risk

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts