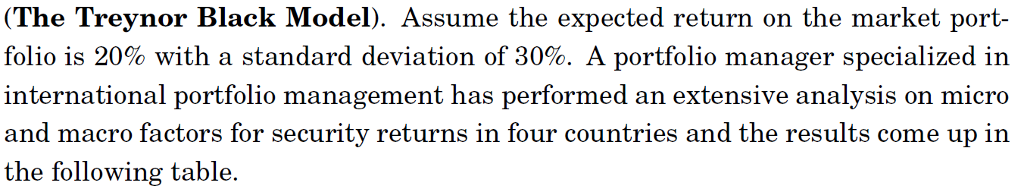

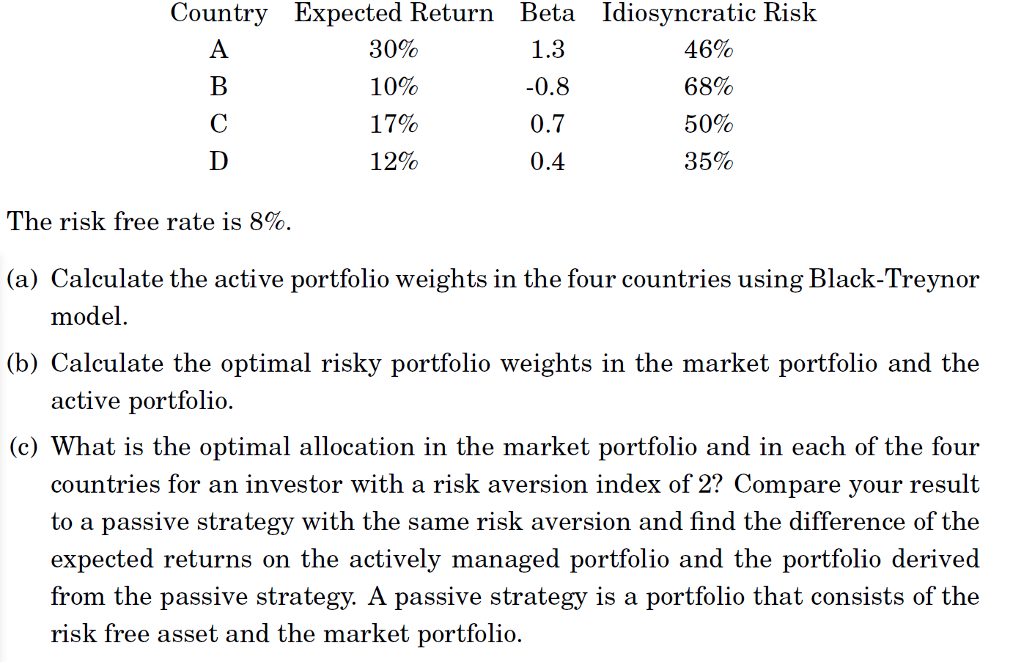

Question: (The Treynor Black Model). Assume the expected return on the market port- folio is 20% with a standard deviation of 30%. A portfolio manager specialized

(The Treynor Black Model). Assume the expected return on the market port- folio is 20% with a standard deviation of 30%. A portfolio manager specialized in international portfolio management has performed an extensive analysis on micro and macro factors for security returns in four countries and the results come up in the following table. Country Expected Return Beta Idiosyncratic Risk 30% 10% 17% 12% 1.3 -0.8 0.7 0.4 46% 68% 50% 35% The risk free rate 1S 8%. (a) Calculate the active portfolio weights in the four countries using Black-Treynor model. (b) Calculate the optimal risky portfolio weights in the market portfolio and the active portfolio (c) What is the optimal allocation in the market portfolio and in each of the four countries for an investor with a risk aversion index of 2? Compare your result to a passive strategy with the same risk aversion and find the difference of the expected returns on the actively managed portfolio and the portfolio derived from the passive strategy. A passive strategy is a portfolio that consists of the risk free asset and the market portfolio (The Treynor Black Model). Assume the expected return on the market port- folio is 20% with a standard deviation of 30%. A portfolio manager specialized in international portfolio management has performed an extensive analysis on micro and macro factors for security returns in four countries and the results come up in the following table. Country Expected Return Beta Idiosyncratic Risk 30% 10% 17% 12% 1.3 -0.8 0.7 0.4 46% 68% 50% 35% The risk free rate 1S 8%. (a) Calculate the active portfolio weights in the four countries using Black-Treynor model. (b) Calculate the optimal risky portfolio weights in the market portfolio and the active portfolio (c) What is the optimal allocation in the market portfolio and in each of the four countries for an investor with a risk aversion index of 2? Compare your result to a passive strategy with the same risk aversion and find the difference of the expected returns on the actively managed portfolio and the portfolio derived from the passive strategy. A passive strategy is a portfolio that consists of the risk free asset and the market portfolio

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts