Question: This exercise requires you to construct a portfolio using actual data. You may use Google finance or Yahoo finance to download historical data of

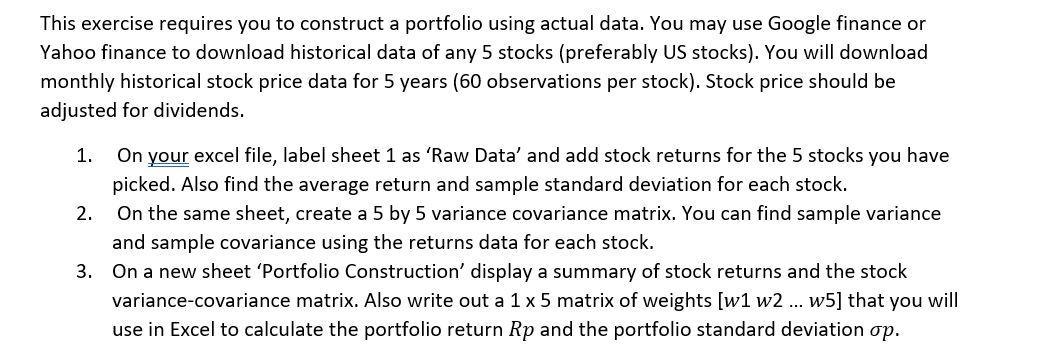

This exercise requires you to construct a portfolio using actual data. You may use Google finance or Yahoo finance to download historical data of any 5 stocks (preferably US stocks). You will download monthly historical stock price data for 5 years (60 observations per stock). Stock price should be adjusted for dividends. 1. On your excel file, label sheet 1 as 'Raw Data' and add stock returns for the 5 stocks you have picked. Also find the average return and sample standard deviation for each stock. 2. On the same sheet, create a 5 by 5 variance covariance matrix. You can find sample variance and sample covariance using the returns data for each stock. 3. On a new sheet 'Portfolio Construction' display a summary of stock returns and the stock variance-covariance matrix. Also write out a 1 x 5 matrix of weights [w1 w2 .. w5] that you will use in Excel to calculate the portfolio return Rp and the portfolio standard deviation op.

Step by Step Solution

There are 3 Steps involved in it

The five years data of two companies NOKIA and Ultra tech are taken The following calculations are made in excel a The return is calculated as Where N... View full answer

Get step-by-step solutions from verified subject matter experts