Question: (This is a multi-step problem. If you make an error in the first step, it is unlikely that you will get the correct answers for

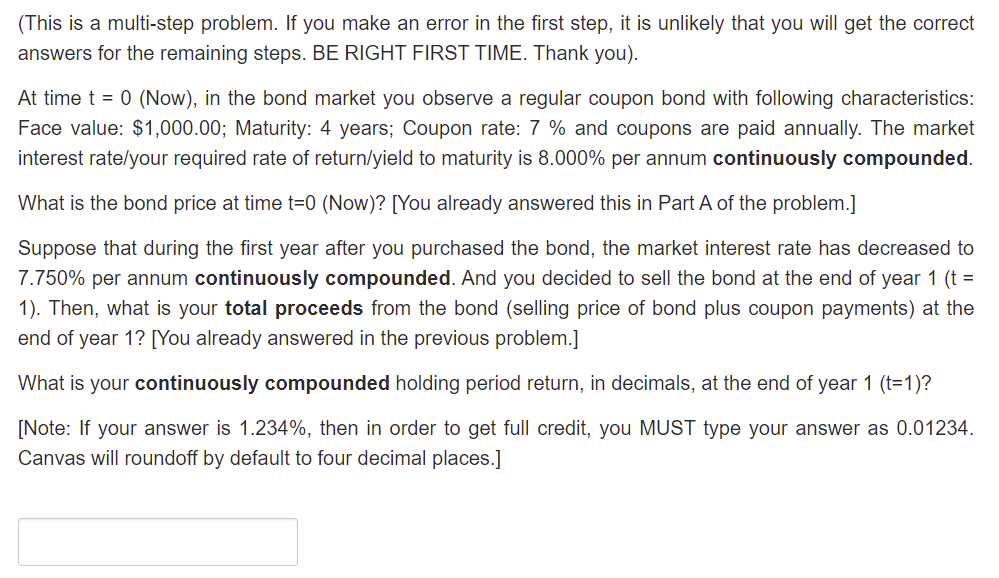

(This is a multi-step problem. If you make an error in the first step, it is unlikely that you will get the correct answers for the remaining steps. BE RIGHT FIRST TIME. Thank you). At time t = 0 (Now), in the bond market you observe a regular coupon bond with following characteristics: Face value: $1,000.00; Maturity: 4 years; Coupon rate: 7 % and coupons are paid annually. The market interest ratelyour required rate of return/yield to maturity is 8.000% per annum continuously compounded. What is the bond price at time t=0 (Now)? [You already answered this in Part A of the problem.] Suppose that during the first year after you purchased the bond, the market interest rate has decreased to 7.750% per annum continuously compounded. And you decided to sell the bond at the end of year 1 (t = 1). Then, what is your total proceeds from the bond (selling price of bond plus coupon payments) at the end of year 1? [You already answered in the previous problem.] What is your continuously compounded holding period return, in decimals, at the end of year 1 (t=1)? [Note: If your answer is 1.234%, then in order to get full credit, you MUST type your answer as 0.01234. Canvas will roundoff by default to four decimal places.]

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts