Question: (This is a multi-step problem. If you make an error in the first step, it is likely that you will get incorrect answers in all

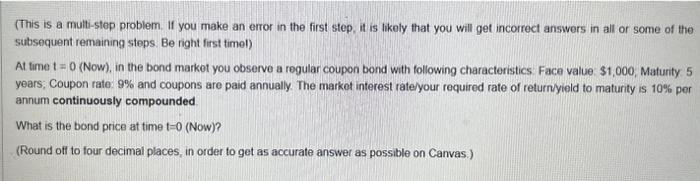

(This is a multi-step problem. If you make an error in the first step, it is likely that you will get incorrect answers in all or some of the subsequent remaining steps. Be night first timel) At time t=0 (Now), in the bond market you observe a regular coupon bond with following characteristics. Face value: $1,000, Maturity 5 years, Coupon rate: 9% and coupons are paid annually. The market interest rate/your required rate of return/yield to maturity is 10% per annum continuously compounded What is the bond price at time t=0 (Now)? (Round off to four decimal places, in order to get as accurate answer as possible on Canvas.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts