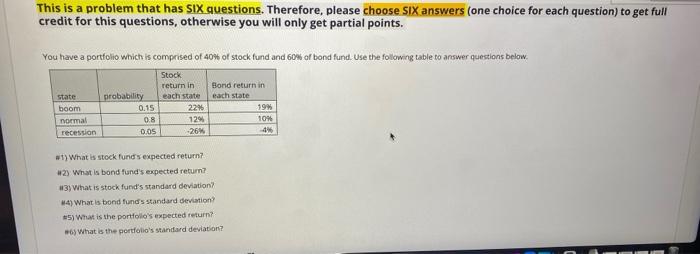

Question: This is a problem that has six questions. Therefore, please choose Six answers (one choice for each question) to get full credit for this questions,

This is a problem that has six questions. Therefore, please choose Six answers (one choice for each question) to get full credit for this questions, otherwise you will only get partial points. You have a portfolio which is comprised of 40% of stock fund and 60% of bond fund. Use the following table to answer questions below. probability 0.15 state boom normal recession Stock return in each state 22% 129 -26% Bond return in each state 19 10% 4% 08 DOS #1) What is stock funds expected return? 29 What is bond fund's expected return 3) What is stock fund's standard deviation? 4) What is bond funds standard deviation? #5) What is the portfolio's expected return? What is the portfolio's standard deviation

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts