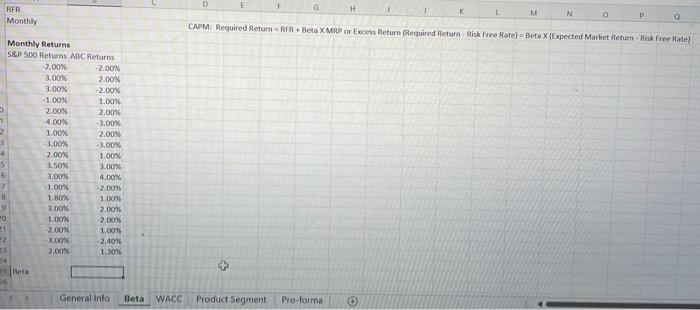

Question: this is all one question please send back in excel format if possible please. CAPM: Required Return = RFR + Beta XMAP or Excess Return

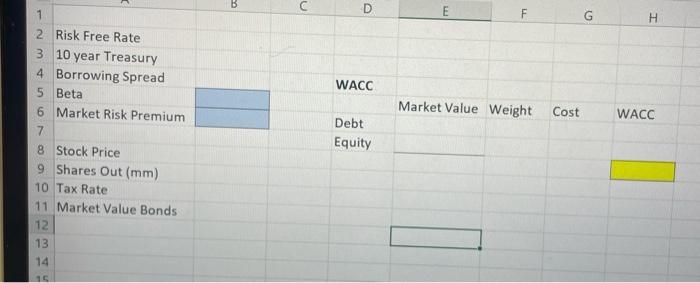

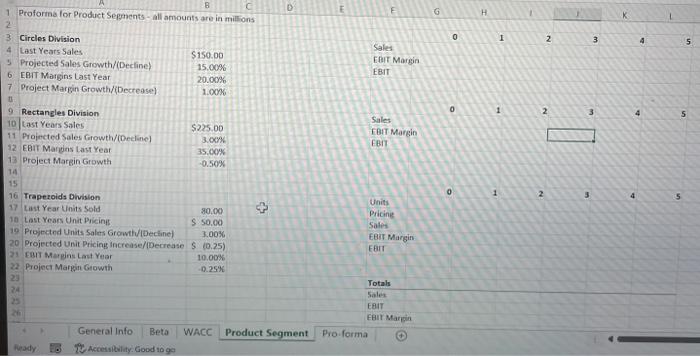

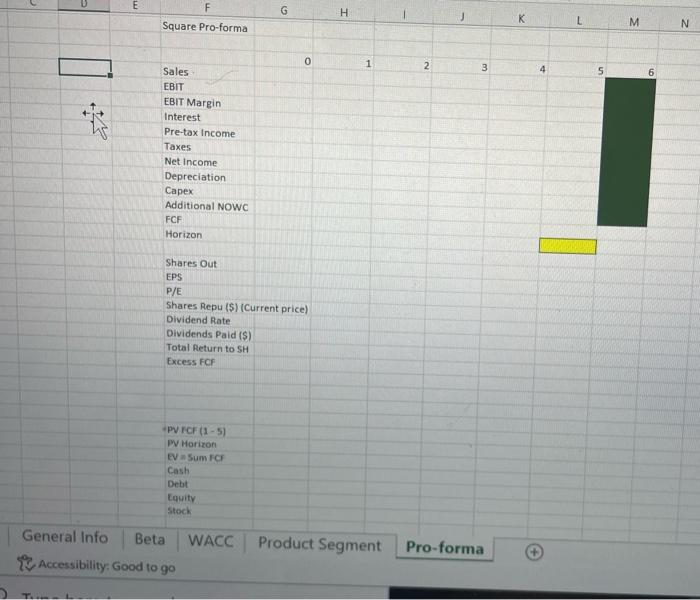

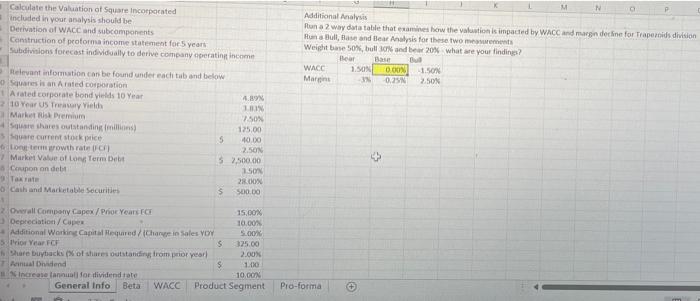

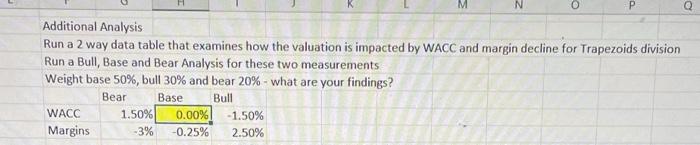

CAPM: Required Return = RFR + Beta XMAP or Excess Return (Required Recturn-Risk Free Rate )= Beta X (Expected Market Heturn - Risi Free Ra1e) 310 year Treasury 4 Borrowing Spread 5 Beta 6 Market Risk Premium WACC \begin{tabular}{l|l|l|l|} \hline & Market Value Weight Cost WACC \\ Debt Equity & & & \\ \hline \end{tabular} 10 Tax Rate 11 Market Value Bonds 12 13 14 \begin{tabular}{ll} Square Pro-forma \\ \hline \end{tabular} Pies a Bult, flate and Hear Achlysis for these two meysuemtet Weight base 50n, bull 10 hand bear 20ac what are your findings? Run a 2 way data table that examines how the valuation is impacted by WACC and margin decline for Trapezoids division Run a Bull, Base and Bear Analysis for these two measurements Weight base 50%, bull 30% and bear 20% - what are your findings? CAPM: Required Return = RFR + Beta XMAP or Excess Return (Required Recturn-Risk Free Rate )= Beta X (Expected Market Heturn - Risi Free Ra1e) 310 year Treasury 4 Borrowing Spread 5 Beta 6 Market Risk Premium WACC \begin{tabular}{l|l|l|l|} \hline & Market Value Weight Cost WACC \\ Debt Equity & & & \\ \hline \end{tabular} 10 Tax Rate 11 Market Value Bonds 12 13 14 \begin{tabular}{ll} Square Pro-forma \\ \hline \end{tabular} Pies a Bult, flate and Hear Achlysis for these two meysuemtet Weight base 50n, bull 10 hand bear 20ac what are your findings? Run a 2 way data table that examines how the valuation is impacted by WACC and margin decline for Trapezoids division Run a Bull, Base and Bear Analysis for these two measurements Weight base 50%, bull 30% and bear 20% - what are your findings

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts