Question: THIS PROBLEM HAS 8 QUESTIONS. EACH QUESTION HAS 4 POSSIBLE ANSWERS. THERE IS A DROPDOWN MENU FOR EACH QUESTION. You are evaluating a product for

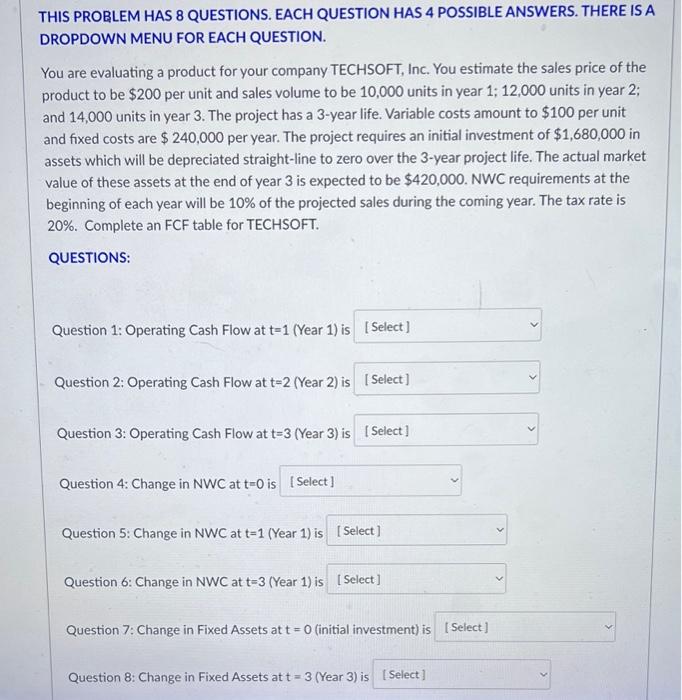

THIS PROBLEM HAS 8 QUESTIONS. EACH QUESTION HAS 4 POSSIBLE ANSWERS. THERE IS A DROPDOWN MENU FOR EACH QUESTION. You are evaluating a product for your company TECHSOFT, Inc. You estimate the sales price of the product to be $200 per unit and sales volume to be 10,000 units in year 1;12,000 units in year 2 ; and 14,000 units in year 3 . The project has a 3-year life. Variable costs amount to $100 per unit and fixed costs are $240,000 per year. The project requires an initial investment of $1,680,000 in assets which will be depreciated straight-line to zero over the 3-year project life. The actual market value of these assets at the end of year 3 is expected to be $420,000. NWC requirements at the beginning of each year will be 10% of the projected sales during the coming year. The tax rate is 20\%. Complete an FCF table for TECHSOFT. QUESTIONS: Question 1: Operating Cash Flow at t=1( Year 1) is Question 2: Operating Cash Flow at t=2 (Year 2) is Question 3: Operating Cash Flow at t=3( Year 3) is Question 4: Change in NWC at t=0 is Question 5: Change in NWC at t=1 (Year 1 ) is Question 6: Change in NWC at t=3 (Year 1 ) is Question 7: Change in Fixed Assets at t=0 (initial investment) is Question 8: Change in Fixed Assets at t=3( Year 3) is

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts