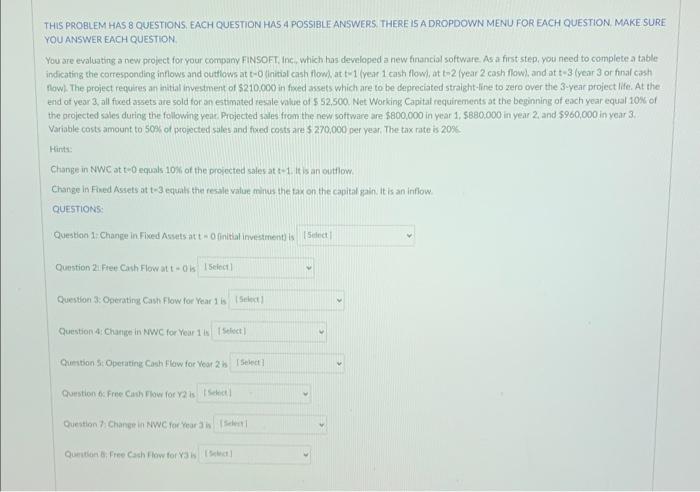

Question: THIS PROBLEM HAS 8 QUESTIONS, EACH QUESTION HAS A POSSIBLE ANSWERS. THERE IS A DROPDOWN MENU FOR EACH QUESTION MAKE SURE YOU ANSWER EACH QUESIION.

THIS PROBLEM HAS 8 QUESTIONS, EACH QUESTION HAS A POSSIBLE ANSWERS. THERE IS A DROPDOWN MENU FOR EACH QUESTION MAKE SURE YOU ANSWER EACH QUESIION. You are evaluating a new project for your company FiNSOFT, inc, which has developed a new financial software, As a first step, you need to complete a table indicating the corresponding inflows and outliows at t-0 linital cash flow), at t-1 (ver 1 cash flow), at to-2 (year 2 cash flow), and at t-3 (year 3 or funal cash flowl. The project requires an intial investment of 5210.000 in fwed assets which are to be depreciated straight-line to zero over the 3 -year project life. At the end of year 3 , all fwed assets are sold for an estmated resale value of $52.500. Net Working Capitat requirements at the beginning of each year equal 10N of the projected sales duting the following yeac. Projected sades from the new software are $800,000 in year 1,$880,000 in year 2 , and $960,000 in year 3 . Variable costs amount to 508 of projected sales and fived costs are $270.000 per year, The tax rate is 209 . Hints: Change in NWC at th0 equals 10 if of the projected sales at t-1. It is an outhow. Change in Fived Assets at t-3 equats the resale value minus the tax on the capital gain it is an inflow. Questions: Question 17 Change in Fixed Assets at t - ofinitial investment is Question 2i Free Carh Flow at t=0 is Question 3: Operating Gash Flow for Year 1 is Question 4i Change in NWC for Year 1 is Qurtion 5: Operating Cash Flow for Year 2K Ruestion 6 freme Curh Flow for Y2 is Question zi Chane in NWC for hear a is Quintion B. Free Cach fiow tor Ya h

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts