Question: This question is a bonus, and will only be counted if you have tried each and every one of the other questions. Anything not tried

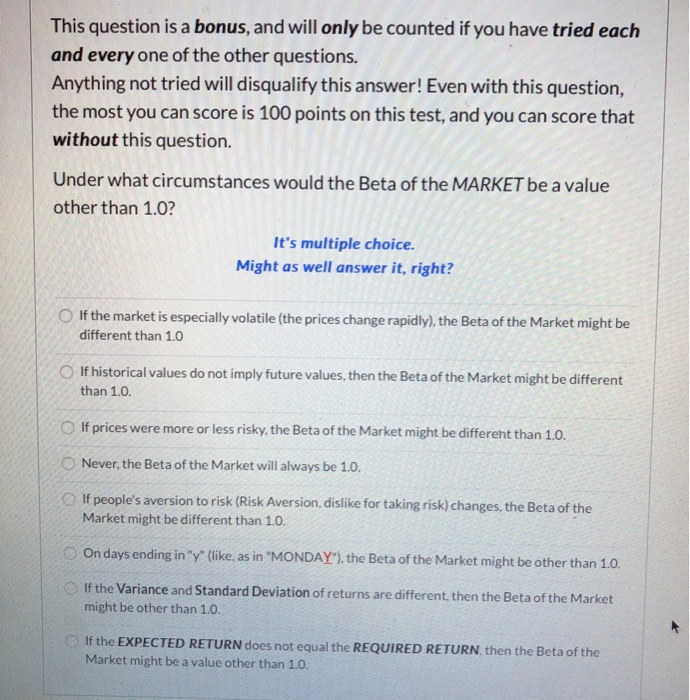

This question is a bonus, and will only be counted if you have tried each and every one of the other questions. Anything not tried will disqualify this answer! Even with this question, the most you can score is 100 points on this test, and you can score that without this question. Under what circumstances would the Beta of the MARKET be a value other than 1.0? It's multiple choice. Might as well answer it, right? If the market is especially volatile (the prices change rapidly), the Beta of the Market might be different than 1.0 If historical values do not imply future values, then the Beta of the Market might be different than 1.0. If prices were more or less risky, the Beta of the Market might be different than 1.0. Never, the Beta of the Market will always be 1.0. If people's aversion to risk (Risk Aversion, dislike for taking risk) changes, the Beta of the Market might be different than 1.0. On days ending in "y" (like, as in "MONDAY"), the Beta of the Market might be other than 1.0. If the Variance and Standard Deviation of returns are different then the Beta of the Market might be other than 1.0. If the EXPECTED RETURN does not equal the REQUIRED RETURN, then the Beta of the Market might be a value other than 1.0

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts