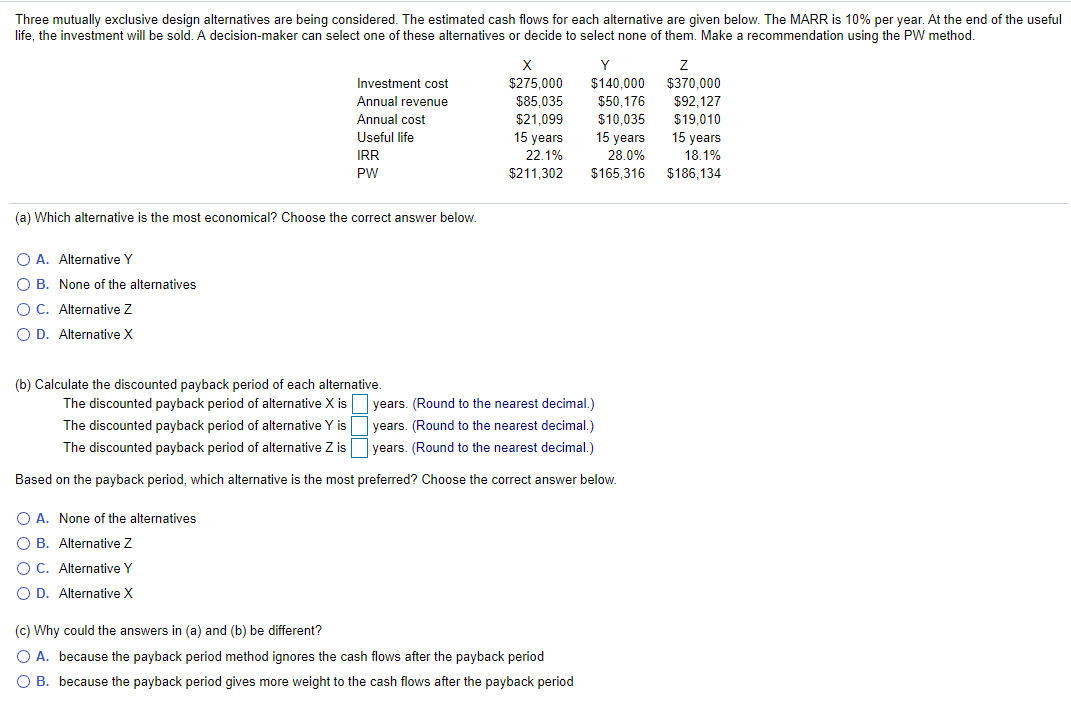

Question: Three mutually exclusive design alternatives are being considered. The estimated cash flows for each alternative are given below. The MARR is 10% per year. At

Three mutually exclusive design alternatives are being considered. The estimated cash flows for each alternative are given below. The MARR is 10% per year. At the end of the useful life, the investment will be sold. A decision-maker can select one of these alternatives or decide to select none of them. Make a recommendation using the PW method $275,000 $85,035 $21,099 Z $370,000 $92.127 Investment cost Annual revenue Annual cost Useful life IRR PW $140.000 $50.176 $10.035 15 years 28.0% $165,316 15 years 22.1% $211,302 $19.010 15 years 18.1% $186.134 (a) Which alternative is the most economical? Choose the correct answer below. O A. Alternative Y O B. None of the alternatives OC. Alternative Z OD. Alternative X (b) Calculate the discounted payback period of each alternative. The discounted payback period of alternative X is years. (Round to the nearest decimal.) The discounted payback period of alternative Y is years. (Round to the nearest decimal.) The discounted payback period of alternative Z is years. (Round to the nearest decimal.) Based on the payback period, which alternative is the most preferred? Choose the correct answer below. O A. None of the alternatives O B. Alternative Z OC. Alternative Y OD. Alternative X (c) Why could the answers in (a) and (b) be different? O A. because the payback period method ignores the cash flows after the payback period O B. because the payback period gives more weight to the cash flows after the payback period

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts