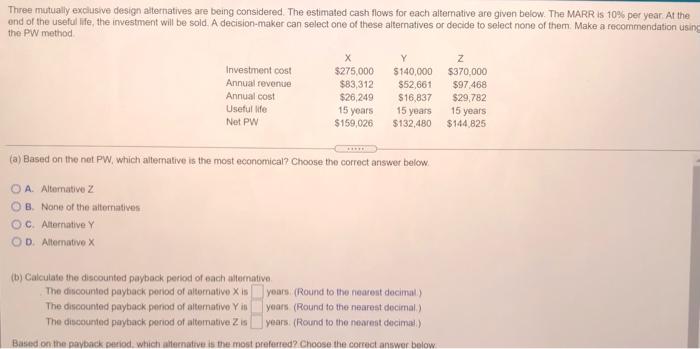

Question: Three mutually exclusive design alternatives are being considered. The estimated cash flows for each alterative are given below. The MARR is 10% per year At

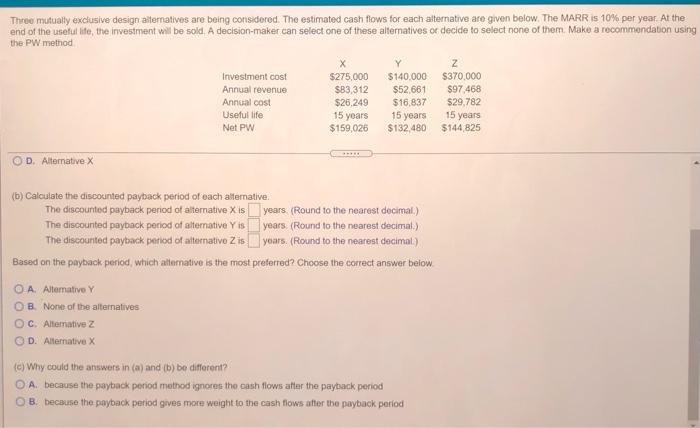

Three mutually exclusive design alternatives are being considered. The estimated cash flows for each alterative are given below. The MARR is 10% per year At the end of the useful life, the investment will be sold. A decision-maker can select one of these alternatives or decide to select none of them. Make a recommendation using the PW method Investment cost Annual revenue Annual cost Useful life Net PW $275,000 $83,312 $26,249 15 years $159,026 $140,000 $52,661 S16 837 15 years $132,480 $370,000 $97.468 $29.782 15 years $144.825 (a) Based on the net PW, which alternative is the most economical? Choose the correct answer below. O A. Alternative z OB. None of the alternatives Oc Alternative Y OD. Alternative X (b) Calculate the discounted payback period of each alternative The discounted payback period of alternative X is yours (Round to the nearest decimal) The discounted payback period of alternativo Yin years (Round to the nearest decimal) The discounted payback period of alterative Zis years. (Round to the nearest decimal) Based on the payback period, which alternative is the most preferred? Choose the correct answer below Three mutually exclusive design alternatives are being considered. The estimated cash flows for each alternative are given below. The MARR is 10% per year. At the end of the useful life, the investment will be sold. A decision-maker can select one of these alternatives or decide to select none of them. Make a recommendation using the PW method Investment cost Annual revenue Annual cost Useful life Net PW $275,000 $83,312 $26,249 15 years $159,026 $140,000 $52.661 $16,837 15 years $132,480 Z $370,000 $97 468 $29,782 15 years $144,825 D. Alternative X (b) Calculate the discounted payback period of each alternative The discounted payback period of alternative X is years (Round to the nearest decimal) The discounted payback period of alternative Y is years (Round to the nearest decimai.) The discounted payback period of alternative Zis yours. (Round to the nearest decimal) Based on the payback period, which alternative is the most preferred? Choose the correct answer below O A Alterative Y OB. None of the alternatives OC. Alternative z D. Alternative X (c) Why could the answers in (a) and (b) be different? O A. because the payback period method ignores the cash flows after the payback period OB. because the payback period gives more weight to the cash flows after the payback period

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts