Question: Total o punts 1. Calculate the expected return for the stock fund for the listed below scenarios (1 point) 2. Calculate standard deviation of returns

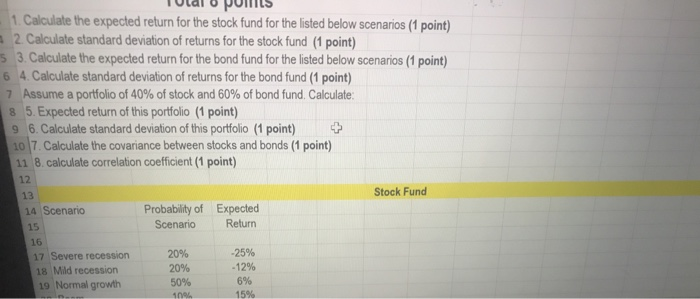

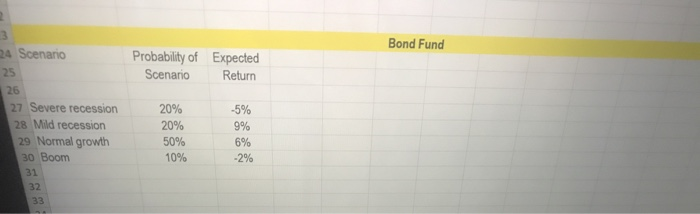

Total o punts 1. Calculate the expected return for the stock fund for the listed below scenarios (1 point) 2. Calculate standard deviation of returns for the stock fund (1 point) 5 3. Calculate the expected return for the bond fund for the listed below scenarios (1 point) 6 4 . Calculate standard deviation of returns for the bond fund (1 point) 7 Assume a portfolio of 40% of stock and 60% of bond fund. Calculate 8 5. Expected return of this portfolio (1 point) 9 6. Calculate standard deviation of this portfolio (1 point) + 10 7. Calculate the covariance between stocks and bonds (1 point) 11 8. calculate correlation coefficient (1 point) 12 Stock Fund 14 Scenario Probability of Expected Scenario Return 16 17 Severe recession 20% -25% 18 Mild recession 20% 19 Normal growth 50% 6% 15% 13 - 12% Bond Fund 24 Scenario 25 Probability of Scenario Expected Return 26 -5% 27 Severe recession 28 Mild recession 29 Normal growth 30 Boom 31 32 33 20% 20% 50% 10%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts