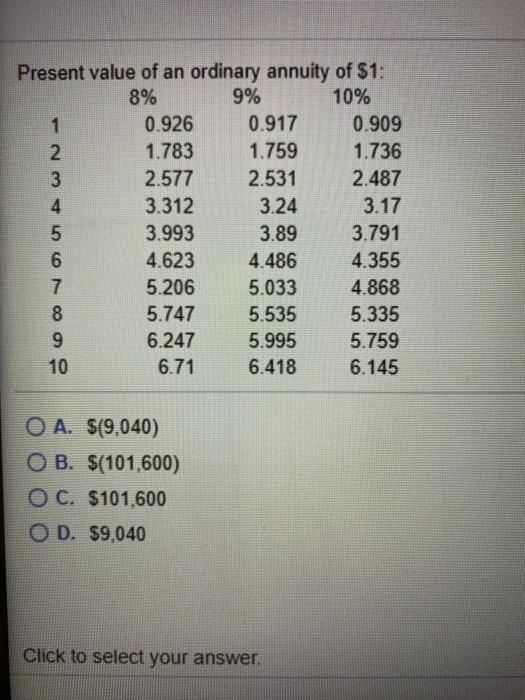

Question: This Question: 3 pts DUR A company is considering an iron ore extraction project that requires an inte investment of 500.000 and will yield annual

This Question: 3 pts DUR A company is considering an iron ore extraction project that requires an inte investment of 500.000 and will yield annual cash nowo5154.000 for four years The company decorate is What is NPV of the project? ordinary annuity of 51 N- Present value of an ordinary annuity of $1: 8% 9% 10% 1 0.926 0.917 0.909 2 1.783 1.759 1.736 3 2.577 2.531 2.487 4 3.312 3.24 3.17 3.993 3.89 3.791 6 4.623 4.486 4.355 7 5.206 5.033 4.868 8 5.747 5.535 5.335 9 6.247 5.995 5.759 10 6.71 6.418 6.145 u O A. $(9.040) O B. $(101.600) O C. $101,600 O D. $9,040 Click to select your

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock