Question: True False O 0 0 0 C O O 0 O O O 0 O 0 4. Large company stocks tend to have larger

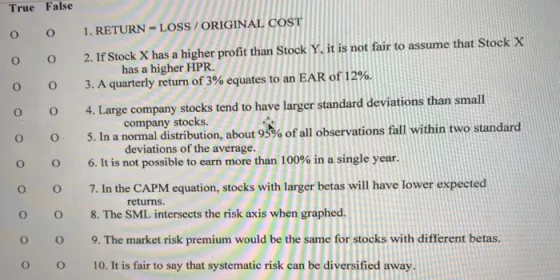

True False O 0 0 0 C O O 0 O O O 0 O 0 4. Large company stocks tend to have larger standard deviations than small company stocks. 5. In a normal distribution, about 95% of all observations fall within two standard deviations of the average. 0 6. It is not possible to earn more than 100% in a single year. O 0 0 O 1. RETURN-LOSS/ORIGINAL COST 2. If Stock X has a higher profit than Stock Y. it is not fair to assume that Stock X has a higher HPR. 3. A quarterly return of 3% equates to an EAR of 12%. O 7. In the CAPM equation, stocks with larger betas will have lower expected returns. 8. The SML intersects the risk axis when graphed. 9. The market risk premium would be the same for stocks with different betas. 10. It is fair to say that systematic risk can be diversified away.

Step by Step Solution

3.31 Rating (145 Votes )

There are 3 Steps involved in it

The detailed answer for the above question is provided below False Returnlossoriginal cost is not a ... View full answer

Get step-by-step solutions from verified subject matter experts