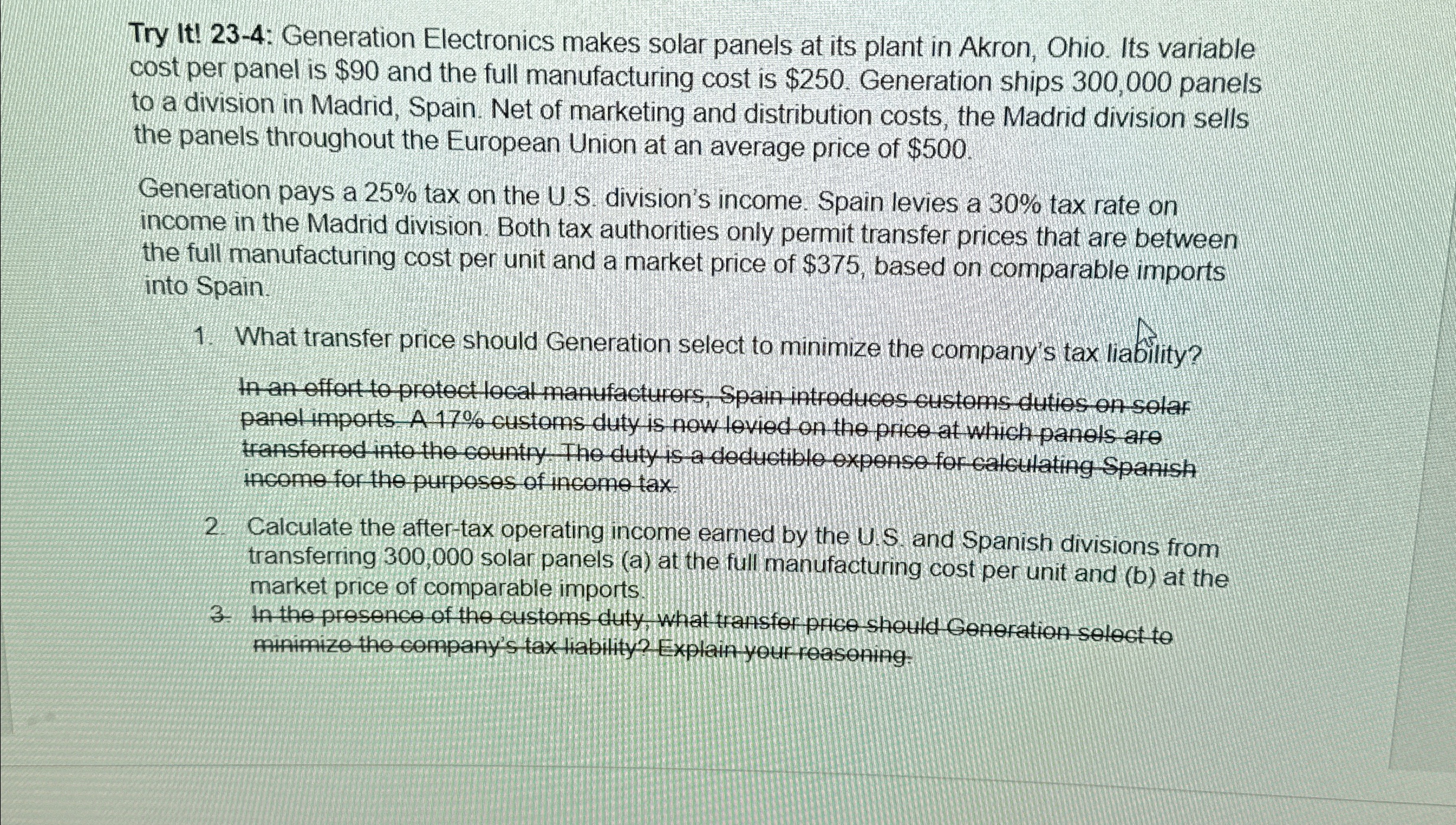

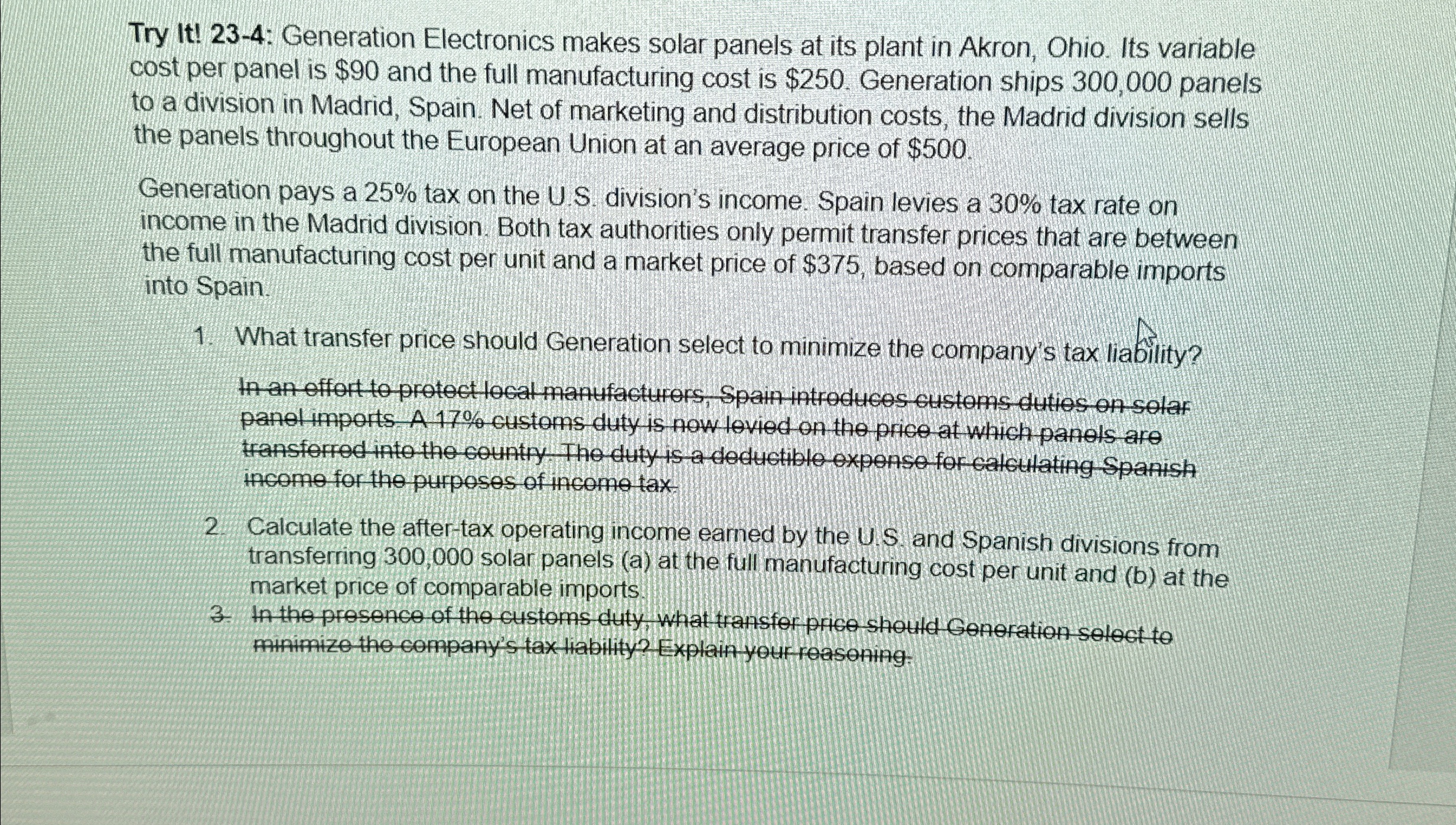

Question: Try It ! 2 3 - 4 : Generation Electronics makes solar panels at its plant in Akron, Ohio. Its variable cost per panel is

Try It: Generation Electronics makes solar panels at its plant in Akron, Ohio. Its variable cost per panel is $ and the full manufacturing cost is $ Generation ships panels to a division in Madrid, Spain. Net of marketing and distribution costs, the Madrid division sells the panels throughout the European Union at an average price of $

Generation pays a tax on the US division's income. Spain levies a tax rate on income in the Madrid division. Both tax authorities only permit transfer prices that are between the full manufacturing cost per unit and a market price of $ based on comparable imports into Spain.

What transfer price should Generation select to minimize the company's tax liability?

panel imports A customs duty is now levied on the price at which panels are transferred into the country The duty is a deductible expense for calculating Spanish income for the purposes of income tax

Calculate the aftertax operating income eamed by the and Spanish divisions from transferring solar panels a at the full manufacturing cost per unit and b at the market price of comparable imports

In the presence of the customs duty, what transfer price should Generation select to

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock