Question: undefined Problem 1: Three-period consumption-savings problem Consider a three-period decision problem: max u(co) + Bu(ci) + B2u(c2) subject to the flow budget constraints for t

undefined

undefined

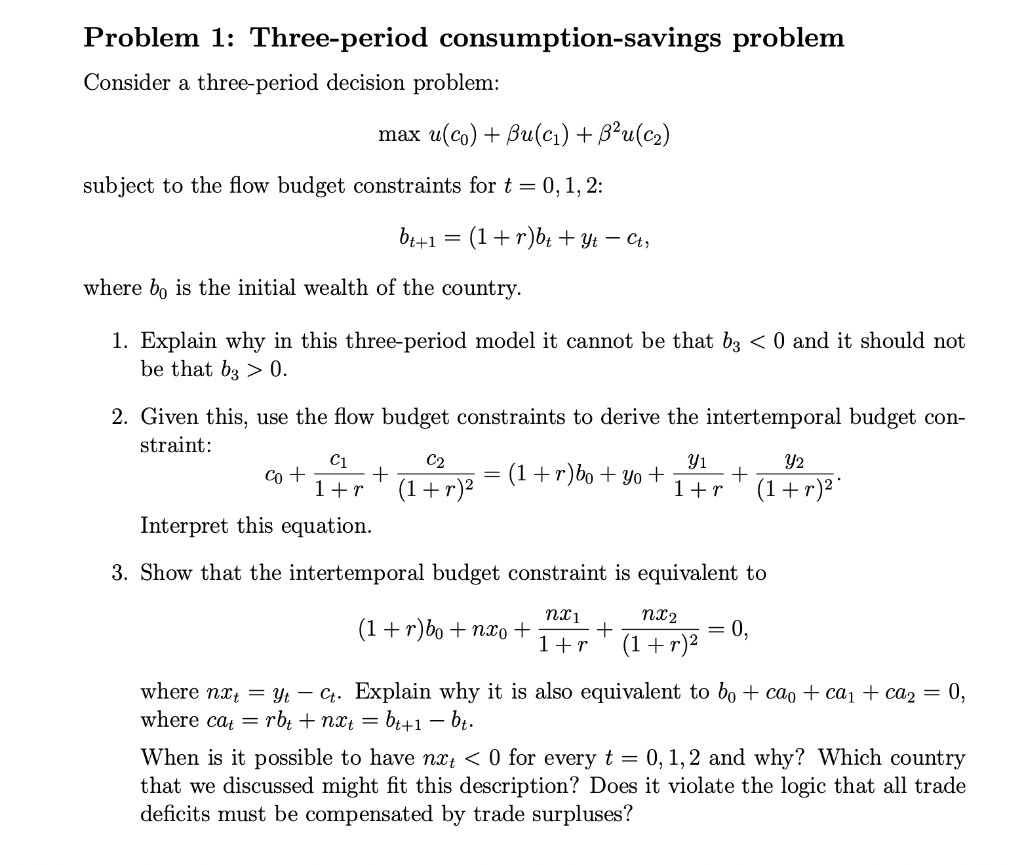

Problem 1: Three-period consumption-savings problem Consider a three-period decision problem: max u(co) + Bu(ci) + B2u(c2) subject to the flow budget constraints for t = 0,1, 2: bt+1 (1+r)bt + yt Ct, where bo is the initial wealth of the country. 1. Explain why in this three-period model it cannot be that b3 0. C1 C2 2. Given this, use the flow budget constraints to derive the intertemporal budget con- straint: Yi Y2 + (1+r)bo + yo + + 1+r (1+r)2 1+r (1 + r)2 Interpret this equation. Co + 3. Show that the intertemporal budget constraint is equivalent to nxi n22 (1+r)bo + nxo + + 0, 1+r (1+r)2 where nxt = Yt - Ct. Explain why it is also equivalent to bo + cao + caj + ca2 = 0, where cat = rbt + nxt = bt+1 bt. When is it possible to have nxt 0. C1 C2 2. Given this, use the flow budget constraints to derive the intertemporal budget con- straint: Yi Y2 + (1+r)bo + yo + + 1+r (1+r)2 1+r (1 + r)2 Interpret this equation. Co + 3. Show that the intertemporal budget constraint is equivalent to nxi n22 (1+r)bo + nxo + + 0, 1+r (1+r)2 where nxt = Yt - Ct. Explain why it is also equivalent to bo + cao + caj + ca2 = 0, where cat = rbt + nxt = bt+1 bt. When is it possible to have nxt

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts