Question: undefined Problem 3. (2 points) Consider two assets: a stock, and a call option on the stock. The possible realizations of the stock price at

undefined

undefined

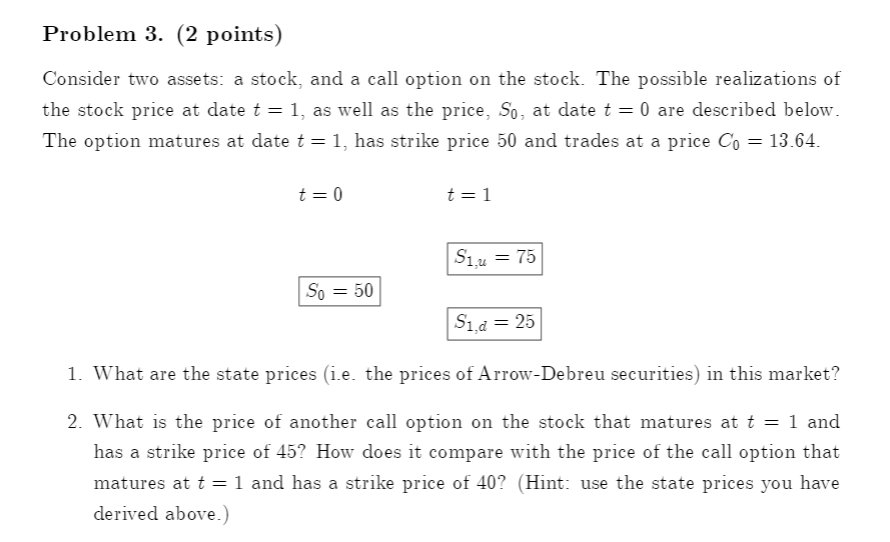

Problem 3. (2 points) Consider two assets: a stock, and a call option on the stock. The possible realizations of the stock price at date t = 1, as well as the price, So, at date t = 0 are described below. The option matures at date t = 1, has strike price 50 and trades at a price Co = 13.64. t=0 t=1 S14 = 75 So = 50 Sid = 25 1. What are the state prices (i.e. the prices of Arrow-Debreu securities) in this market? 2. What is the price of another call option on the stock that matures at t = 1 and has a strike price of 45? How does it compare with the price of the call option that matures at t=1 and has a strike price of 40? (Hint: use the state prices you have derived above.) Problem 3. (2 points) Consider two assets: a stock, and a call option on the stock. The possible realizations of the stock price at date t = 1, as well as the price, So, at date t = 0 are described below. The option matures at date t = 1, has strike price 50 and trades at a price Co = 13.64. t=0 t=1 S14 = 75 So = 50 Sid = 25 1. What are the state prices (i.e. the prices of Arrow-Debreu securities) in this market? 2. What is the price of another call option on the stock that matures at t = 1 and has a strike price of 45? How does it compare with the price of the call option that matures at t=1 and has a strike price of 40? (Hint: use the state prices you have derived above.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts