Question: ur, Ub minutes, 56 seconds. Question Completion Status: 16 25 2 26 9 10 6 30 110 27 29 28 140 11 20 21 22

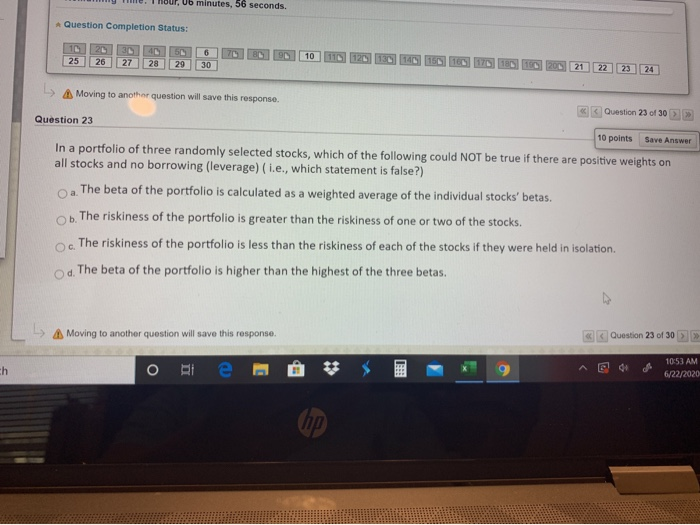

ur, Ub minutes, 56 seconds. Question Completion Status: 16 25 2 26 9 10 6 30 110 27 29 28 140 11 20 21 22 23 24 Moving to another question will save this response. Question 23 of 30 Question 23 10 points Save Answer In a portfolio of three randomly selected stocks, which of the following could NOT be true if there are positive weights on all stocks and no borrowing (leverage) (i.e., which statement is false?) The beta of the portfolio is calculated as a weighted average of the individual stocks' betas. The riskiness of the portfolio is greater than the riskiness of one or two of the stocks. The riskiness of the portfolio is less than the riskiness of each of the stocks if they were held in isolation The beta of the portfolio is higher than the highest of the three betas. O. . d. Moving to another question will save this response. Question 23 of 30 ch E 10:53 AM 6/22/2020 hp

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts