Question: URGENT. Please be detailed when providing the solution. Give FULL explanation. Include ALL the calculations, graphs etc. Handwritten solution only. NO EXCEL GENERATED. thanks Two

URGENT. Please be detailed when providing the solution. Give FULL explanation. Include ALL the calculations, graphs etc. Handwritten solution only. NO EXCEL GENERATED. thanks

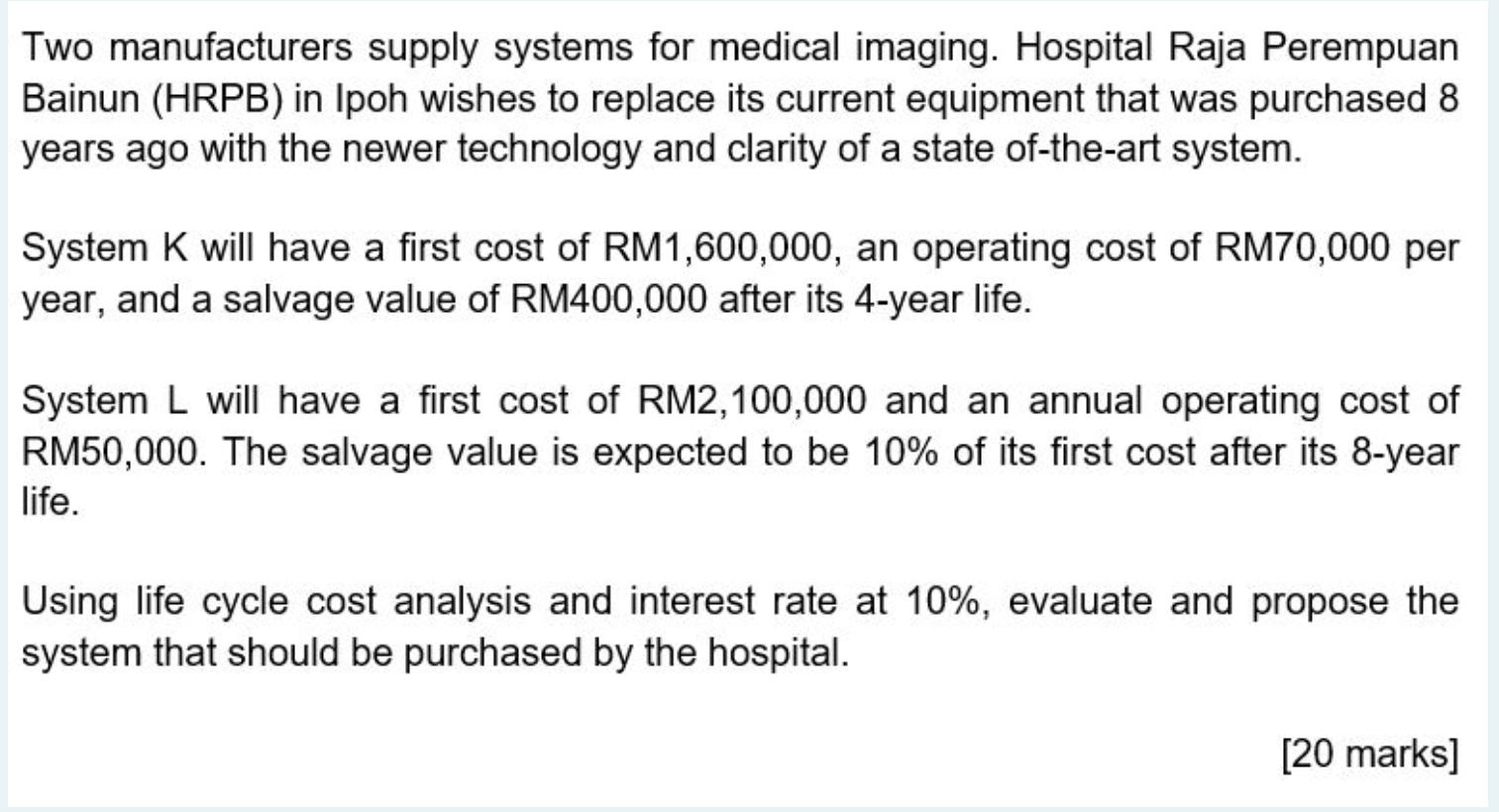

Two manufacturers supply systems for medical imaging. Hospital Raja Perempuan Bainun (HRPB) in Ipoh wishes to replace its current equipment that was purchased 8 years ago with the newer technology and clarity of a state of-the-art system. System K will have a first cost of RM1,600,000, an operating cost of RM70,000 per year, and a salvage value of RM400,000 after its 4-year life. System L will have a first cost of RM2,100,000 and an annual operating cost of RM50,000. The salvage value is expected to be 10% of its first cost after its 8-year life. Using life cycle cost analysis and interest rate at 10%, evaluate and propose the system that should be purchased by the hospital. [20 marks]

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts