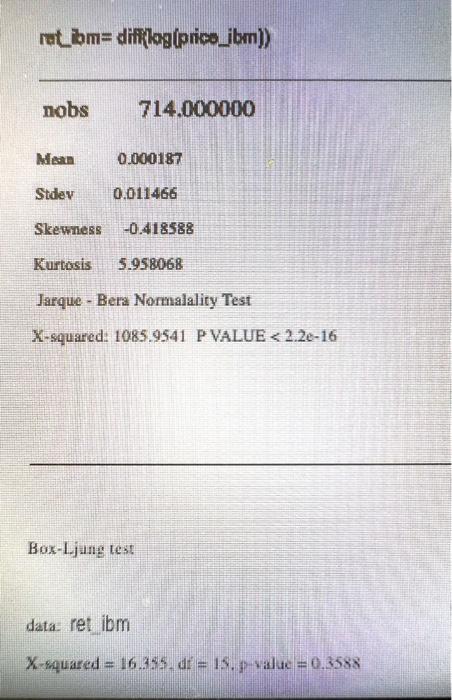

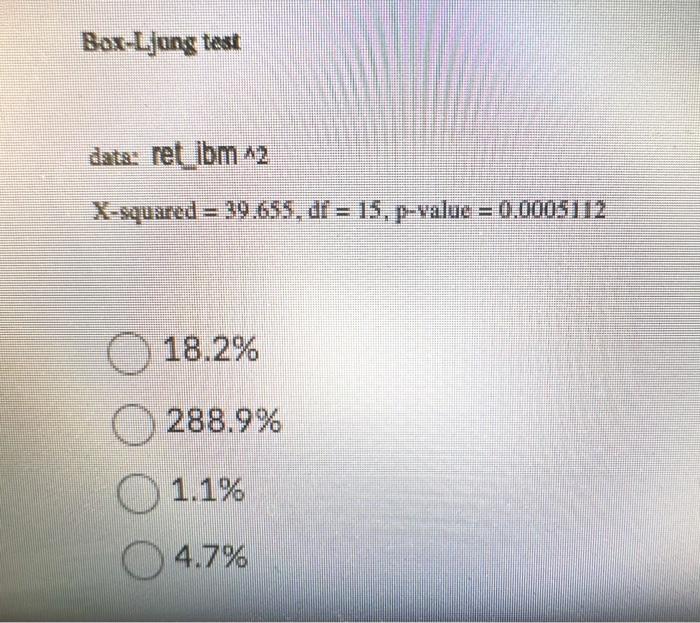

Question: Use the daily data for IBM below: RIBM is the log return of ibm adjusted closing prices. What is the annualized volatility of IBM? rot_bm

Use the daily data for IBM below: RIBM is the log return of ibm adjusted closing prices. What is the annualized volatility of IBM?

rot_bm = difilog (prico_jbmi) Box-Ljang test data. ret ibm Bax-Ljung test data: ret lom A2 X-squared =39.655 18.2% 288.9% 1.1% 4.7% rot_bm = difilog (prico_jbmi) Box-Ljang test data. ret ibm Bax-Ljung test data: ret lom A2 X-squared =39.655 18.2% 288.9% 1.1% 4.7%

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock