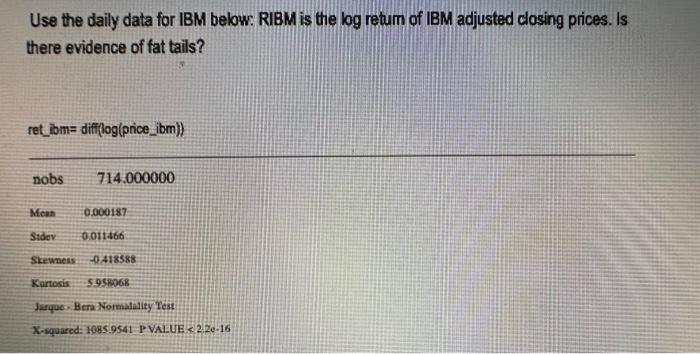

Question: Use the daily data for IBM below: RIBM is the log retum of IBM adjusted closing prices. Is there evidence of fat tails? ret_ibm= difflog(price_ibm))

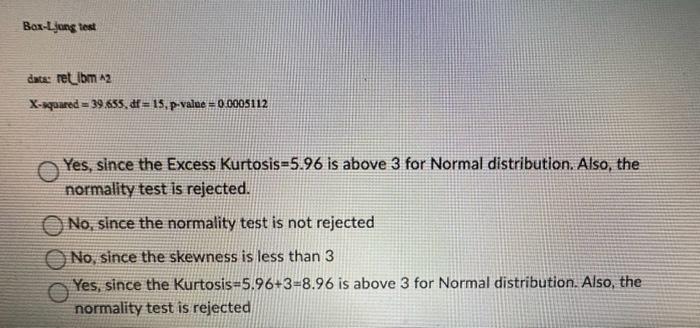

Use the daily data for IBM below: RIBM is the log retum of IBM adjusted closing prices. Is there evidence of fat tails? ret_ibm= difflog(price_ibm)) Bax-Ljong tost dates retibm 2 x-aqaared =39.655, df =15, p-value =0.0005112 Yes, since the Excess Kurtosis =5.96 is above 3 for Normal distribution. Also, the normality test is rejected. No, since the normality test is not rejected No, since the skewness is less than 3 Yes, since the Kurtosis =5.96+3=8.96 is above 3 for Normal distribution. Also, the normality test is rejected

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock