Question: Use the information below to help answer questions 19-21. Both Portfolio X and Portfolio Y use the same benchmark. All metrics are annualized and do

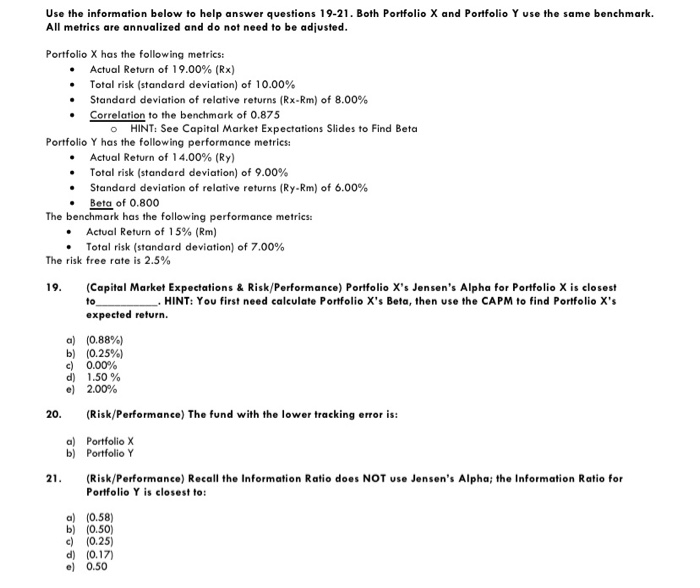

Use the information below to help answer questions 19-21. Both Portfolio X and Portfolio Y use the same benchmark. All metrics are annualized and do not need to be adjusted. Portfolio X has the following metrics: Actual Return of 19.00% (Rx) Total risk (standard deviation) of 10.00% Standard deviation of relative returns (Rx-Rm) of 8.00% Correlation to the benchmark of 0.875 HINT: See Capital Market Expectations Slides to Find Beta Portfolio Y has the following performance metrics: Actual Return of 14.00% (Ry) Total risk (standard deviation) of 9.00% Standard deviation of relative returns (Ry-Rm) of 6.00% Beta of 0.800 The benchmark has the following performance metrics: Actual Return of 15% (Rm) Total risk (standard deviation) of 7.00% The risk free rate is 2.5% 19. (Capital Market Expectations & Risk/Performance) Portfolio X's Jensen's Alpha for Portfolio X is closest HINT: You first need calculate Portfolio X's Beta, then use the CAPM to find Portfolio X's expected return. a) (0.88%) b) (0.25%) c) 0.00% d) 1.50 % e) 2.00% 20. (Risk/Performance) The fund with the lower tracking error is: a) Portfolio X b) Portfolio Y 21. (Risk/Performance) Recall the Information Ratio does NOT use Jensen's Alpha; the Information Ratio for Portfolio Y is closest to: a) b) c) d) e) (0.58) (0.50) (0.25) (0.17) 0.50

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts