Question: Use the NPV method to determine whener Kyler Products shauld imvest in the following projects: - Project A: Costs $280,000 and oters eight annual net

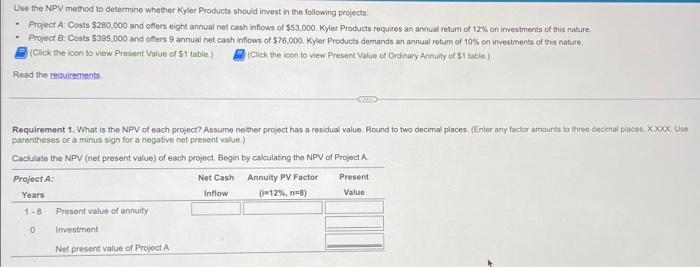

Use the NPV method to determine whener Kyler Products shauld imvest in the following projects: - Project A: Costs $280,000 and oters eight annual net cash inflows of $53,000. Kyler Products recuires an annual return of 12% on irvestments of this nature. - Propect B: Costs $395,000 and oters 9 annual net cash inflows of $76.000. Kyler Products demands an annual retuen of 10% on investments of this nature. (Cick the icon to view Present Value of St table.) (Cick the icon to view Present Value ot Ordinacy Annuity of 51 table.) Read the requirements. Requirement 1. What is the NPV of each projoct? Assume nether project has a residual value. Round to two decimal piaces, (Enier any factor amounts to theee cecimal places, XXOC, Use parentheses or a minus sign for a negative not present value) Caclulate the NPV (net present value) of each project Begin by calculating the NPV of Project A

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts