Question: PLEASE ANSWER USING EXCEL FORMAT POSTED BELOW a) Determine the market value of debt b) Determine the market value of equity c) Determine the market

PLEASE ANSWER USING EXCEL FORMAT POSTED BELOW

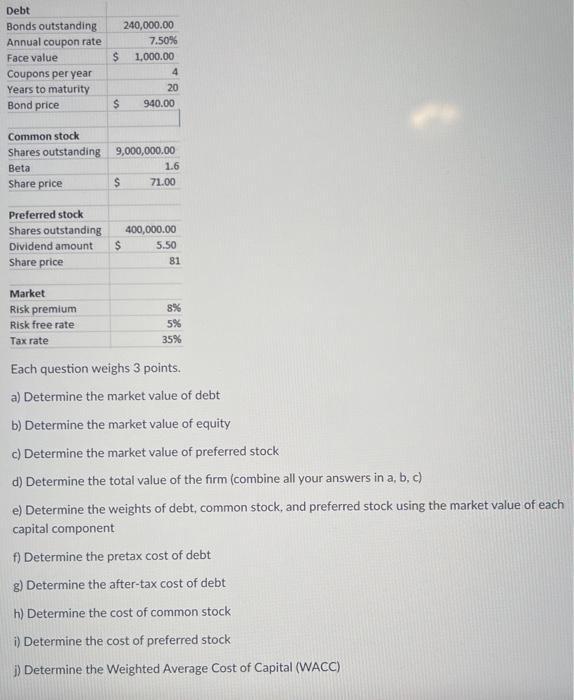

a) Determine the market value of debtb) Determine the market value of equity

c) Determine the market value of preferred stock

c) Determine the total value of the firm combine allyour answers in a, b. c/

e) Determine the weights of debt, common stock, and preferred stock using the market value of each

captial component

1 Determine the pretax cost of debt

g) Determine the after-tax cost of debt

h) Determine the cost of common stock

I Determine the cost of preferred stock

j Determine the Weighted Average Cost of Capital (WACC)

Debt Bonds outstanding Annual coupon rate Face value Coupons per year Years to maturity Bond price 240,000.00 7.50% $ 1,000.00 $ Market Risk premium Risk free rate Tax rate Common stock Shares outstanding 9,000,000.00 Beta Share price 4 20 940.00 Preferred stock Shares outstanding Dividend amount $ Share price 1.6 $ 71.00 400,000.00 5.50 81 8% 5% 35% Each question weighs 3 points. a) Determine the market value of debt b) Determine the market value of equity c) Determine the market value of preferred stock d) Determine the total value of the firm (combine all your answers in a, b, c) e) Determine the weights of debt, common stock, and preferred stock using the market value of each capital component f) Determine the pretax cost of debt g) Determine the after-tax cost of debt h) Determine the cost of common stock i) Determine the cost of preferred stock j) Determine the Weighted Average Cost of Capital (WACC)

Step by Step Solution

3.34 Rating (160 Votes )

There are 3 Steps involved in it

To provide the requested information in Excel format I will create a table with the relevant data and perform the calculations accordingly Heres how the table would look A B C 1 Market Value Market Va... View full answer

Get step-by-step solutions from verified subject matter experts