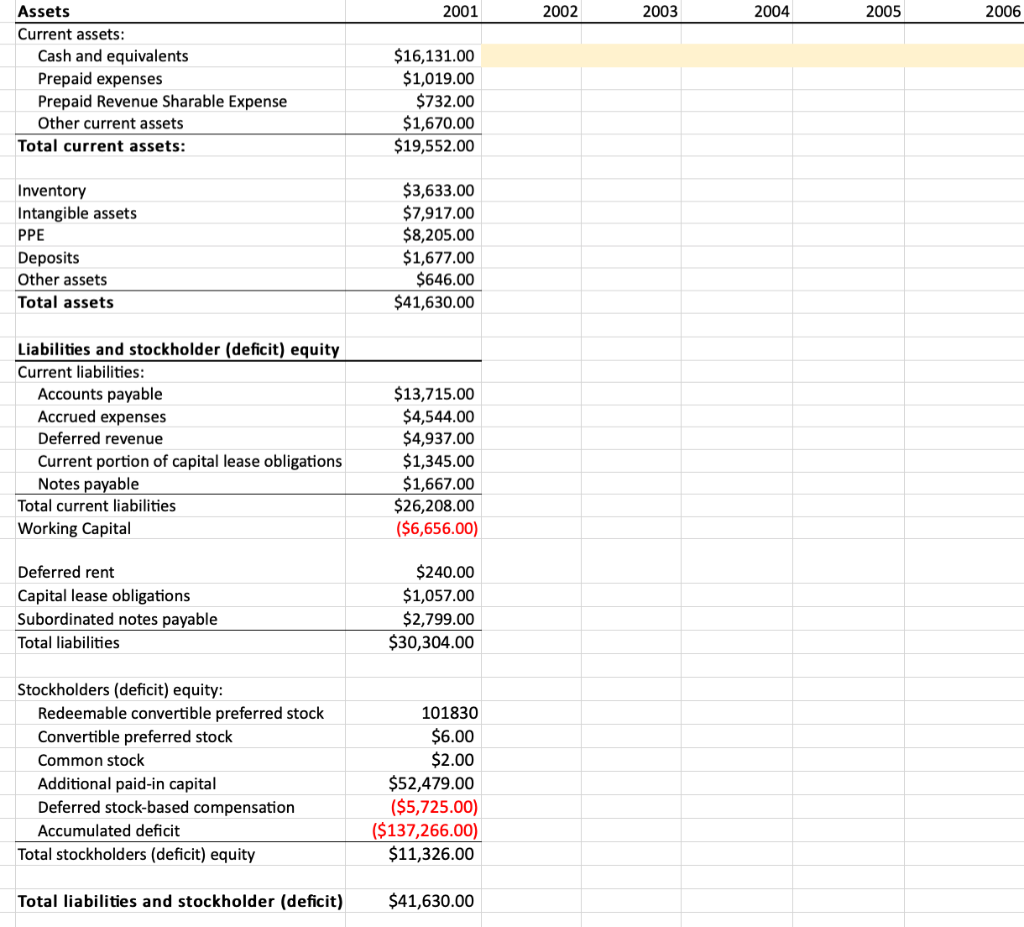

Question: Using the Balance sheet shown above, create assumptions for the balance sheet and perform a 5 year forecasting model using these assumptions. Please show all

Using the Balance sheet shown above, create assumptions for the balance sheet and perform a 5 year forecasting model using these assumptions. Please show all formulas used in excel. Will leave positive feedback for best response.

Using the Balance sheet shown above, create assumptions for the balance sheet and perform a 5 year forecasting model using these assumptions. Please show all formulas used in excel. Will leave positive feedback for best response.

Assets 2001 2002 2003 2004 2005 2006 \begin{tabular}{|l|r|} \hline Current assets: & $16,131.00 \\ \hline Cash and equivalents & $1,019.00 \\ \hline Prepaid expenses & $732.00 \\ \hline Prepaid Revenue Sharable Expense & $1,670.00 \\ \hline Other current assets & $19,552.00 \\ \hline Total current assets: & \\ & $3,633.00 \\ \hline Inventory & $7,917.00 \\ \hline Intangible assets & $8,205.00 \\ \hline PPE & $1,677.00 \\ \hline Deposits & $646.00 \\ \hline Other assets & $41,630.00 \\ \hline Total assets & \\ \hline \end{tabular} Liabilities and stockholder (deficit) equity Current liabilities: \begin{tabular}{|l|r|} \hline Accounts payable & $13,715.00 \\ \hline Accrued expenses & $4,544.00 \\ \hline Deferred revenue & $4,937.00 \\ \hline Current portion of capital lease obligations & $1,345.00 \\ \hline Notes payable & $1,667.00 \\ \hline Total current liabilities & $26,208.00 \\ \hline Working Capital & ($6,656.00) \\ & \\ Deferred rent & $240.00 \\ \hline Capital lease obligations & $1,057.00 \\ \hline Subordinated notes payable & $2,799.00 \\ \hline Total liabilities & $30,304.00 \\ \hline \end{tabular} Stockholders (deficit) equity: \begin{tabular}{|l|r|} \hline Redeemable convertible preferred stock & 101830 \\ \hline Convertible preferred stock & $6.00 \\ \hline Common stock & $2.00 \\ \hline Additional paid-in capital & $52,479.00 \\ \hline Deferred stock-based compensation & ($5,725.00) \\ \hline Accumulated deficit & ($137,266.00) \\ \hline Total stockholders (deficit) equity & $11,326.00 \\ \hline \end{tabular} Total liabilities and stockholder (deficit) $41,630.00 Assets 2001 2002 2003 2004 2005 2006 \begin{tabular}{|l|r|} \hline Current assets: & $16,131.00 \\ \hline Cash and equivalents & $1,019.00 \\ \hline Prepaid expenses & $732.00 \\ \hline Prepaid Revenue Sharable Expense & $1,670.00 \\ \hline Other current assets & $19,552.00 \\ \hline Total current assets: & \\ & $3,633.00 \\ \hline Inventory & $7,917.00 \\ \hline Intangible assets & $8,205.00 \\ \hline PPE & $1,677.00 \\ \hline Deposits & $646.00 \\ \hline Other assets & $41,630.00 \\ \hline Total assets & \\ \hline \end{tabular} Liabilities and stockholder (deficit) equity Current liabilities: \begin{tabular}{|l|r|} \hline Accounts payable & $13,715.00 \\ \hline Accrued expenses & $4,544.00 \\ \hline Deferred revenue & $4,937.00 \\ \hline Current portion of capital lease obligations & $1,345.00 \\ \hline Notes payable & $1,667.00 \\ \hline Total current liabilities & $26,208.00 \\ \hline Working Capital & ($6,656.00) \\ & \\ Deferred rent & $240.00 \\ \hline Capital lease obligations & $1,057.00 \\ \hline Subordinated notes payable & $2,799.00 \\ \hline Total liabilities & $30,304.00 \\ \hline \end{tabular} Stockholders (deficit) equity: \begin{tabular}{|l|r|} \hline Redeemable convertible preferred stock & 101830 \\ \hline Convertible preferred stock & $6.00 \\ \hline Common stock & $2.00 \\ \hline Additional paid-in capital & $52,479.00 \\ \hline Deferred stock-based compensation & ($5,725.00) \\ \hline Accumulated deficit & ($137,266.00) \\ \hline Total stockholders (deficit) equity & $11,326.00 \\ \hline \end{tabular} Total liabilities and stockholder (deficit) $41,630.00

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts