Question: Using the notation: overstated (+), understated (-), or no effect (O), and the amount involved, indicate the effects of the following independent transactions on each

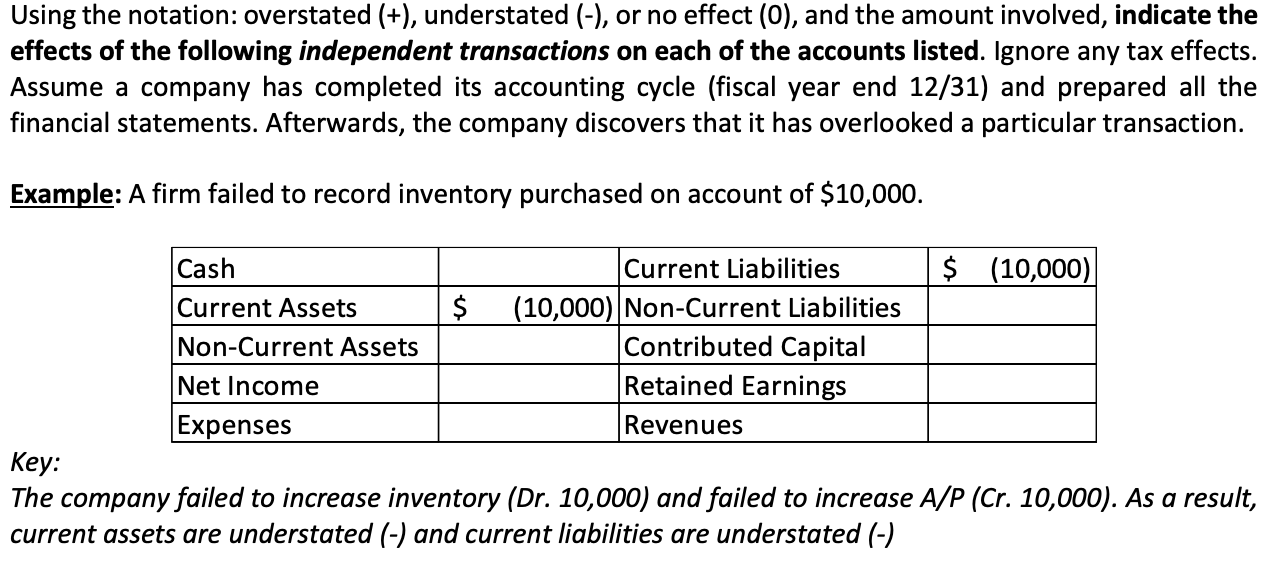

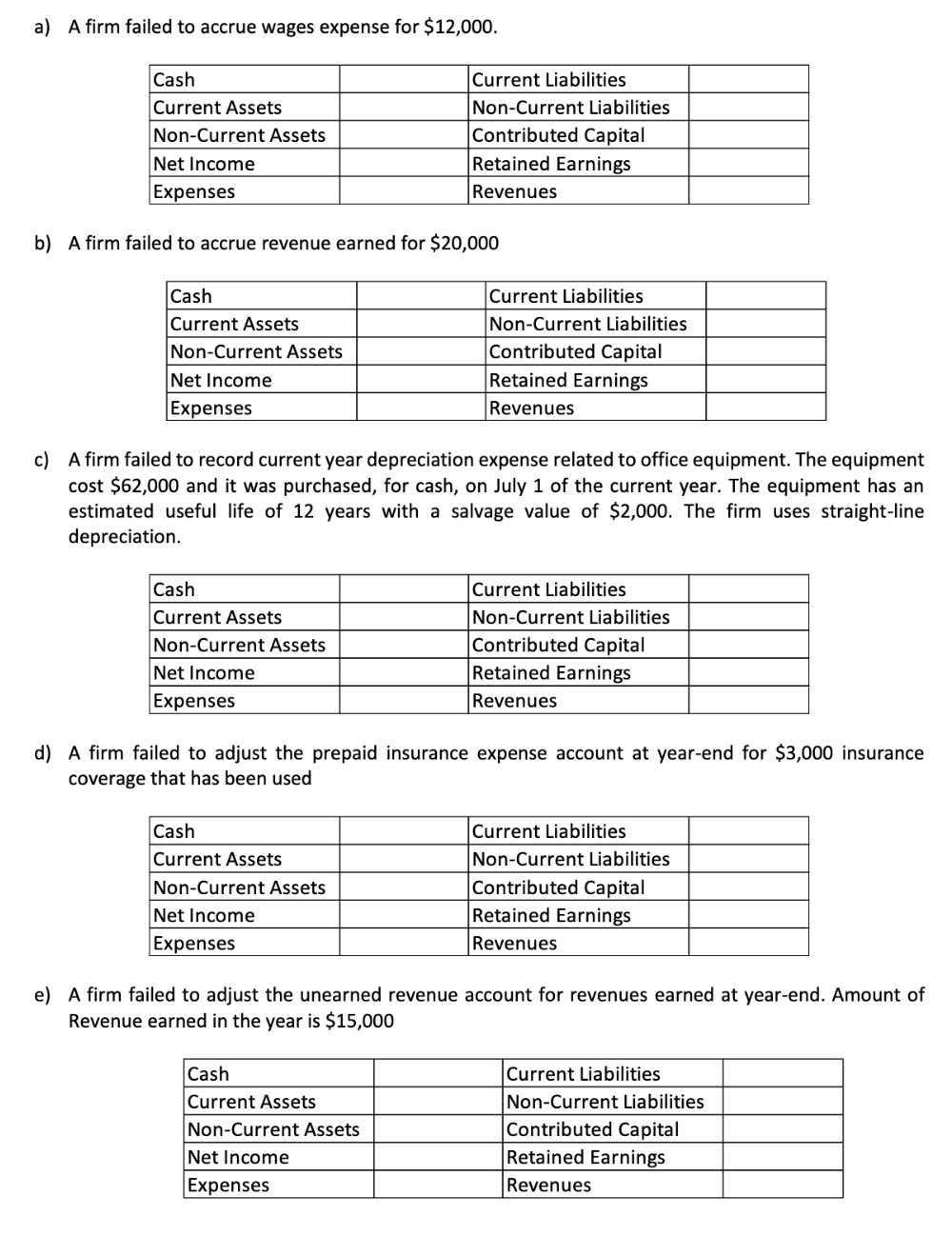

Using the notation: overstated (+), understated (-), or no effect (O), and the amount involved, indicate the effects of the following independent transactions on each of the accounts listed. Ignore any tax effects. Assume a company has completed its accounting cycle (fiscal year end 12/31) and prepared all the financial statements. Afterwards, the company discovers that it has overlooked a particular transaction. Example: A firm failed to record inventory purchased on account of $10,000. Cash Current Liabilities $ (10,000) Current Assets $ (10,000) Non-Current Liabilities Non-Current Assets Contributed Capital Net Income Retained Earnings Expenses Revenues Key: The company failed to increase inventory (Dr. 10,000) and failed to increase A/P (Cr. 10,000). As a result, current assets are understated (-) and current liabilities are understated (-) a) A firm failed to accrue wages expense for $12,000. Cash Current Assets Non-Current Assets Net Income Expenses Current Liabilities Non-Current Liabilities Contributed Capital Retained Earnings Revenues b) A firm failed to accrue revenue earned for $20,000 Cash Current Assets Non-Current Assets Net Income Expenses Current Liabilities Non-Current Liabilities Contributed Capital Retained Earnings Revenues c) A firm failed to record current year depreciation expense related to office equipment. The equipment cost $62,000 and it was purchased, for cash, on July 1 of the current year. The equipment has an estimated useful life of 12 years with a salvage value of $2,000. The firm uses straight-line depreciation. Cash Current Assets Non-Current Assets Net Income Expenses Current Liabilities Non-Current Liabilities Contributed Capital Retained Earnings Revenues d) A firm failed to adjust the prepaid insurance expense account at year-end for $3,000 insurance coverage that has been used Cash Current Assets Non-Current Assets Net Income Expenses Current Liabilities Non-Current Liabilities Contributed Capital Retained Earnings Revenues e) A firm failed to adjust the unearned revenue account for revenues earned at year-end. Amount of Revenue earned in the year is $15,000 Cash Current Assets Non-Current Assets Net Income Expenses Current Liabilities Non-Current Liabilities Contributed Capital Retained Earnings Revenues

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts