Question: Use the EOY values based on those projected for 2018 (not actual for 2017) Assume same number of shares outstanding and a stock price of

Use the EOY values based on those projected for 2018 (not actual for 2017)

- Assume same number of shares outstanding and a stock price of 91.18

- EPS is calculated as NI/shares

Accomplish these 4 steps

- Calculate the corporate valuation of P&G for 2018 using the 4 evaluation methods. You mustshow your work to derive the valuation for credit.

- What is the most likely value of the firm and why?

- Comment on the goodwill & intangibles; significance?

- Comment on the treasury stock and effect; significance?

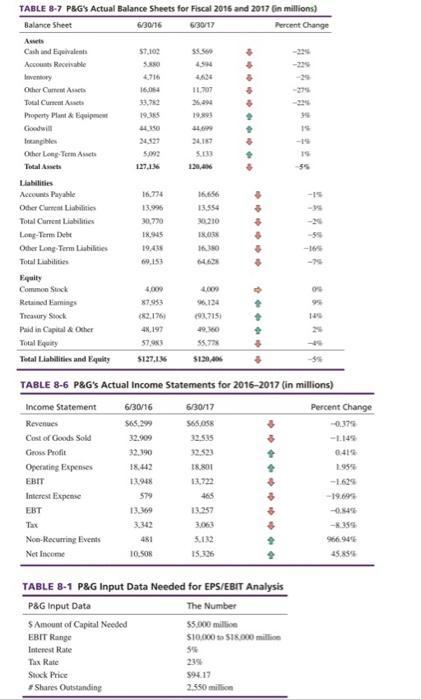

TABLE 8-7 P&G's Actual Balance Sheets for Fiscal 2016 and 2017 (in millions) Balance Sheet 6/30/16 6/30/17 Percent Change Assets Cash and Equivalents Accounts Receivable Inventory Other Current Assets Total Current Assets Property Plant & Equipment Goodwill Intangibles Other Long-Term Assets Total Assets Liabilities Accounts Payable Other Current Liabilities Total Current Liabilities Long-Term Debt Other Long-Term Liabilities Total Liabilities Equity Common Stock Retained Earnings Treasury Stock Paid in Capital & Other Total Equity Total Liabilities and Equity Non-Recurring Events Net Income 57,102 5.880 16,064 33,782 19,385 44,350 Tax Rate Stock Price #Shares Outstanding 5,092 127,136 16,774 13,996 30,770 18.945 19,438 69,153 4,009 (82,176) 48,197 57,983 $127,136 6/30/16 $65,299 32.909 18,442 13.948 579 13,369 3.342 4.594 4624 11.707 26,494 19,893 44,099 24.187 5.133 120,406 10,508 16.656 13.554 30,210 18.038 16,380 4,009 (93,715) 49,360 55,778 $120,406 6/30/17 $65,058 32.535 32.523 18,801 13,722 465 13.257 3.063 5.132 15,326 TABLE 8-6 P&G's Actual Income Statements for 2016-2017 (in millions) Income Statement Revenues Cost of Goods Sold Gross Profit Operating Expenses EBIT Interest Expense EBT Tax 44006 $94.17 2.550 million 4 + & TABLE 8-1 P&G Input Data Needed for EPS/EBIT Analysis P&G Input Data The Number $ Amount of Capital Needed $5,000 million EBIT Range $10,000 $18.000 million Interest Rate 5% 23% 4 36 19 19 -5% -15 -39 -5% -16% -74 05 95 149 Percent Change -0.37% -1.14% 0419 1.95% -1.629 -19.699 -0.84% -K.35% 966.94% 45,85%

Step by Step Solution

3.38 Rating (164 Votes )

There are 3 Steps involved in it

1 Corporate Valuation of PG for 2018 Net Income 16739 Shares Outstanding 3046 PriceEarnings Ratio PE ... View full answer

Get step-by-step solutions from verified subject matter experts