Question: Variance and standard deviation (expected). Hull Consultants, a famous think tank in the Midwest, has provided probability estimates for the four potential economic states for

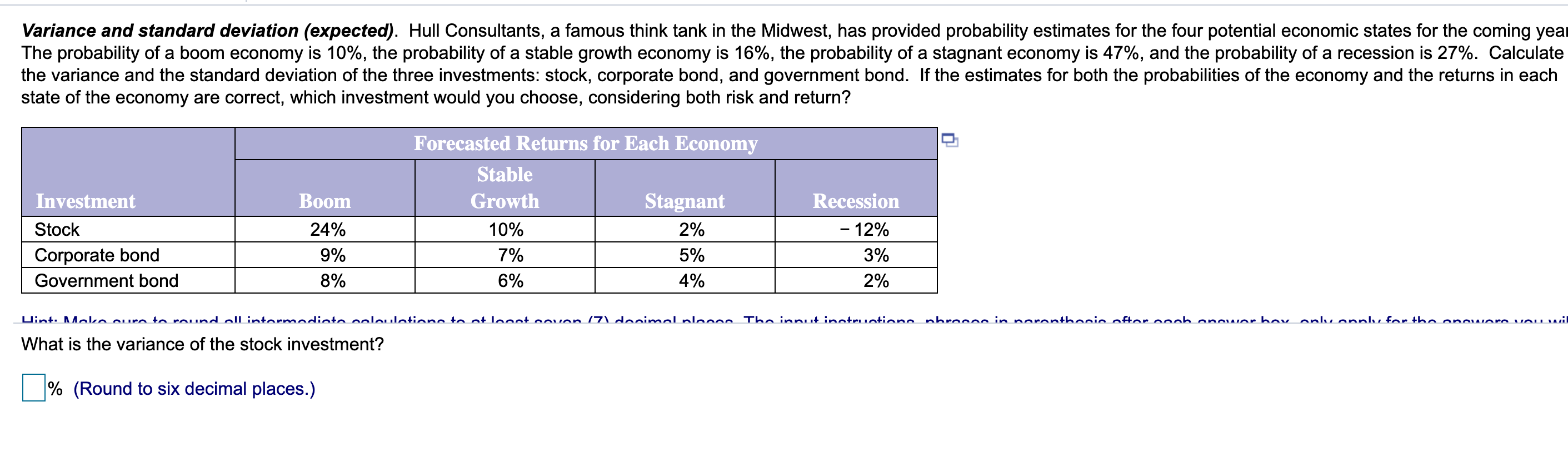

Variance and standard deviation (expected). Hull Consultants, a famous think tank in the Midwest, has provided probability estimates for the four potential economic states for the coming yea The probability of a boom economy is 10%, the probability of a stable growth economy is 16%, the probability of a stagnant economy is 47%, and the probability of a recession is 27%. Calculate the variance and the standard deviation of the three investments: stock, corporate bond, and government bond. If the estimates for both the probabilities of the economy and the returns in each state of the economy are correct, which investment would you choose, considering both risk and return? Boom Investment Stock Corporate bond Government bond Forecasted Returns for Each Economy Stable Growth Stagnant 10% 2% 7% 5% 6% 4% 24% 9% 8% Recession - 12% 3% 2% Uint. Malco cura to round all intermediate coloulation to atlanot neuon (71donimol nonno Thainnut instruction, nhronne in noronthonie oftar ooh onowar havonly only for the onoworo vou wil What is the variance of the stock investment? % (Round to six decimal places.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts