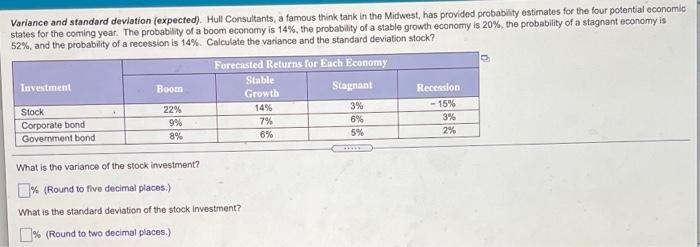

Question: Variance and standard deviation (expected). Hull Consultants, a famous think tank in the Midwest, has provided probability estimates for the four potential economic states for

Variance and standard deviation (expected). Hull Consultants, a famous think tank in the Midwest, has provided probability estimates for the four potential economic states for the coming year. The probability of a boom economy is 14%, the probability of a stable growth economy is 20%, the probability of a stagnant economy is 52%, and the probability of a recession is 14%. Calculate the variance and the standard deviation stock? Forecasted Returns for Each Economy Investment Stable Boom Growth Stagnant Recession Stock 22% 14% 3% -15% Corporate bond 9% 7% 6% 3% Government bond 8% 6% 5% 2% What is the variance of the stock investment? % (Round to five decimal places.) What is the standard deviation of the stock investment? 0% (Round to two decimal places.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts