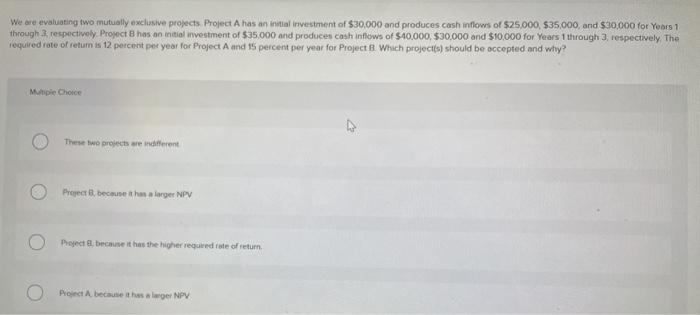

Question: We are evaluating two mutually exclusive projects Project A has an initial investment of $30.000 and produces cash inflows of $25,000 $35,000 and $30,000 for

We are evaluating two mutually exclusive projects Project A has an initial investment of $30.000 and produces cash inflows of $25,000 $35,000 and $30,000 for Yours 1 through 3, respectively Project has an initial investment of $35.000 and produces Cashinews of $40,000 $30,000 and $10,000 for Years 1 through 3, respectively. The required rate of return in 12 percent per year for Project A and 15 percent per year for Project which projects) should be accepted and why? Multiple Choice These two projects are indifferent Project because it has a larger NPV Project l, because it has the higher required role of return O Hordt because it has alwe NPV

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts