Question: What is the probability that, in any given future year, the VIOO return will be -30% or worse? Round your answer to three decimal places.

What is the probability that, in any given future year, the VIOO return will be -30% or worse? Round your answer to three decimal places.

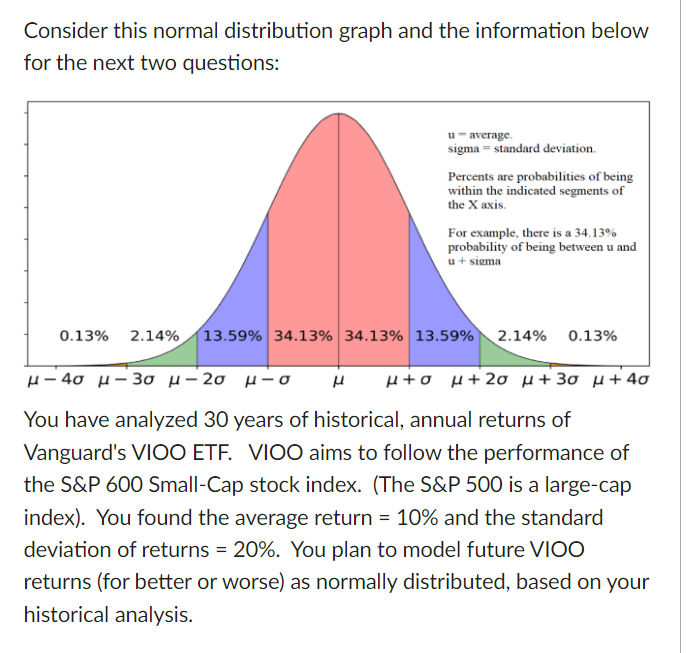

Consider this normal distribution graph and the information below for the next two questions: You have analyzed 30 years of historical, annual returns of Vanguard's VIOO ETF. VIOO aims to follow the performance of the S\&P 600 Small-Cap stock index. (The S\&P 500 is a large-cap index). You found the average return =10% and the standard deviation of returns =20%. You plan to model future VIOO returns (for better or worse) as normally distributed, based on your historical analysis

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts