Question: what values do i enter in the excel functions to find the pv and npv for these types of tables Net present value. Independent projects

what values do i enter in the excel functions to find the pv and npv for these types of tables

what values do i enter in the excel functions to find the pv and npv for these types of tables

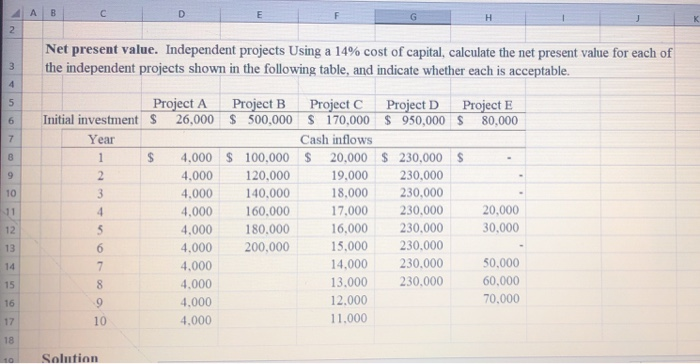

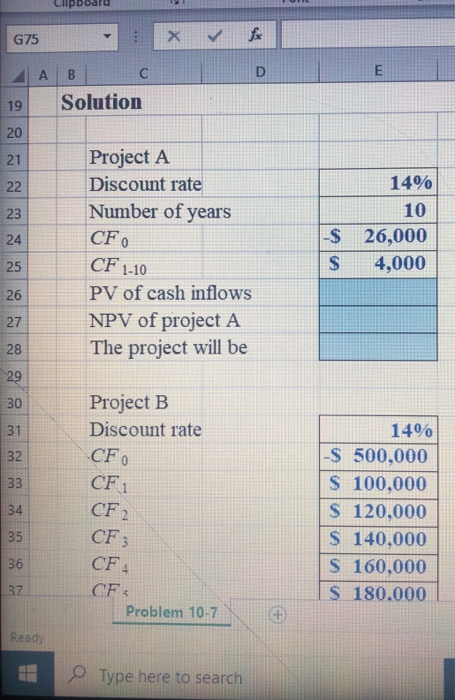

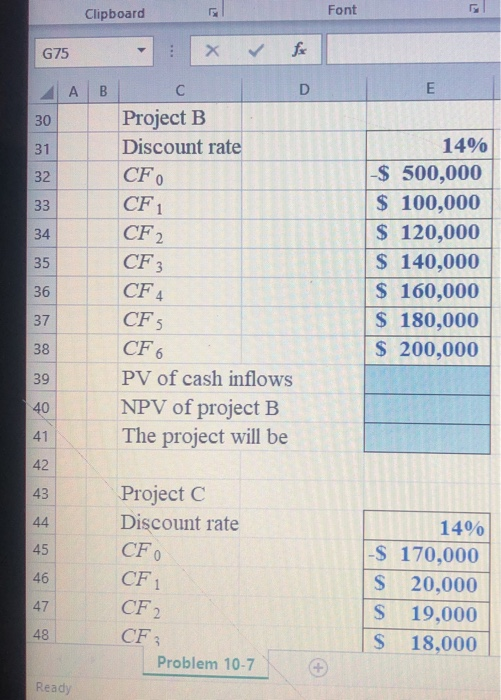

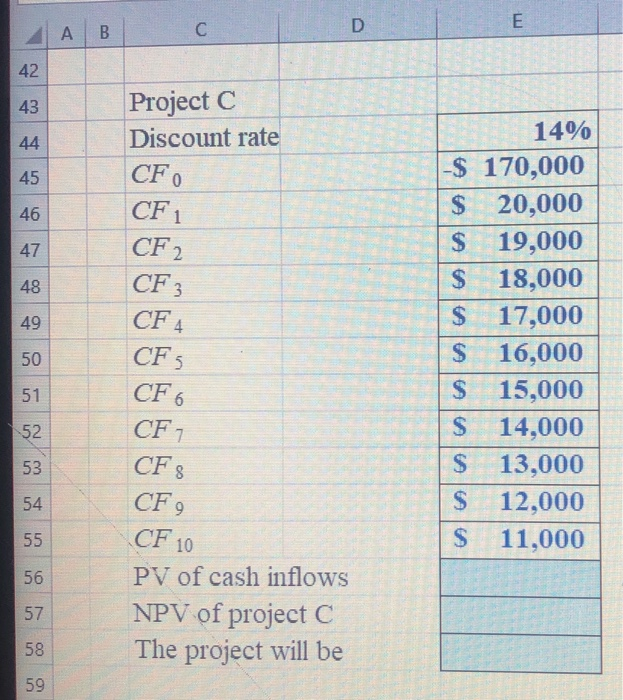

Net present value. Independent projects Using a 14% cost of capital, calculate the net present value for each of the independent projects shown in the following table, and indicate whether each is acceptable. Project B $500,000 Project D $ 950,000 Project E $ 80,000 $ Project A Initial investment $ 26,000 Year 1 $ 4,000 4,000 4.000 4,000 4.000 4,000 4,000 4.000 4,000 4.000 100,000 120,000 140,000 160,000 180,000 200,000 Project C $ 170,000 Cash inflows $ 20,000 19.000 18,000 17.000 16,000 15.000 14,000 13,000 12.000 11.000 $ 230,000 230,000 230,000 230,000 230.000 230,000 230.000 230,000 20,000 30,000 50,000 60,000 70,000 Solution Clipboard G75 Solution Project A Discount rate Number of years CF 14% 10 26,000 4,000 -$ CF 1-10 PV of cash inflows NPV of project A The project will be Project B Discount rate CF, CF1 CF2 CF: 14% -$ 500,000 S 100,000 S 120.000 S 140,000 S 160,000 S 180.000 CF CF. Problem 10-7 Ready Type here to search Clipboard Font G75 LAB fx D E - x C Project B Discount rate CF CF1 CF 2 14% $ 500,000 $ 100,000 $ 120,000 140,000 $ 160,000 $ 180,000 $ 200,000 CF3 CF 4 CF CF6 PV of cash inflows NPV of project B The project will be Project C Discount rate CFO CF1 CF 2 CF3 Problem 10-7 14% -$ 170,000 $ 20,000 $ 19,000 $ 18,000 Ready | Project C Discount rate CF, | | 14% |-$ 170,000 $ 20,000 $ 19,000 $ 18,000 $ 17,000 CF1 CF 2 CF3 | | | CFA $ 16,000 CFS CF 6 01 02 CF, DELL LATITUDE 01 CFS 15,000 14,000 13,000 12,000 11,000 | | | CF, CF 10 PV of cash inflows NPV of project C The project will be | | | |

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts