Question: Which statement is correct for a risk parity portfolio: The risk contribution of each asset to the portfolio is the same The return contribution of

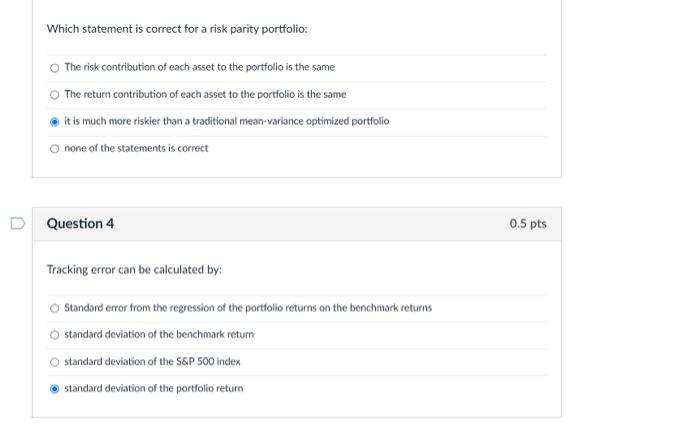

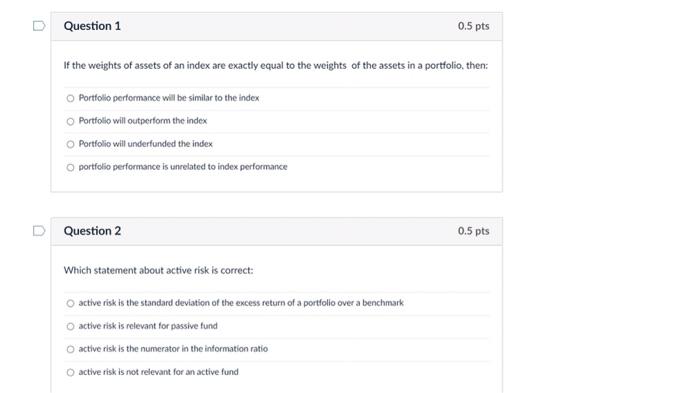

Which statement is correct for a risk parity portfolio: The risk contribution of each asset to the portfolio is the same The return contribution of each asset to the portfolio is the same it is much more riskier than a traditional mean-variance optimized portfolio none of the statements is correct Question 4 0.5pts Tracking error can be calculated by: Standard error from the regression of the portfolio returns on the benchmark returns standard deviation of the benchmark retum standard deviation of the S\&P 500 index standard deviation of the portfolio return If the weights of assets of an index are exactly equal to the weights of the assets in a portfolio, then: Portfollo performance will be similar to the index Portfolio will outperform the index Portfolio will underfunded the index portfolio performance is uncelated to index performance Question 2 0.5 pts Which statement about active risk is correct: active risk is the standard deviation of the excess return of a portfolio over a benchmark active risk is relevant for passive fund active risk is the numerator in the information ratio active risk is not relevant for an active fund

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts