Question: WHY NPV IS BETTER THAN IRR ( 40 points) Read and analyze the given scenario and answer the given questions. Buffett University recently hosted a

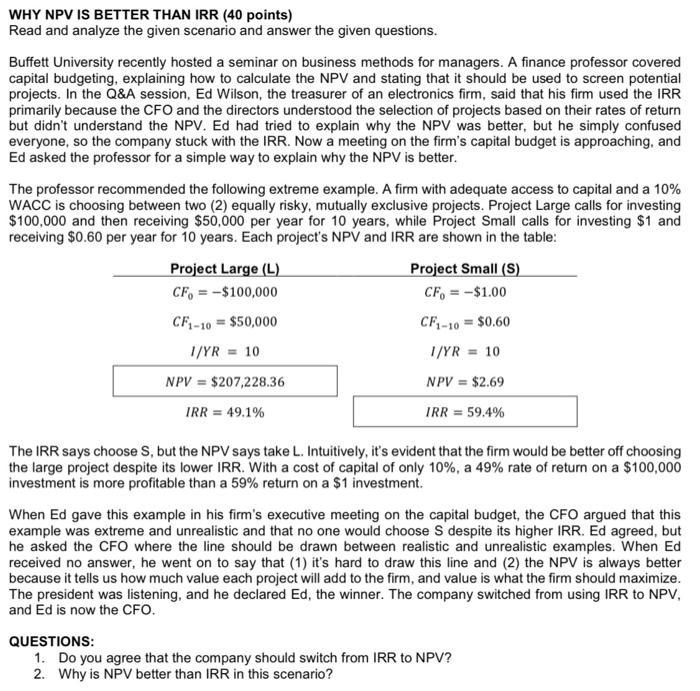

WHY NPV IS BETTER THAN IRR ( 40 points) Read and analyze the given scenario and answer the given questions. Buffett University recently hosted a seminar on business methods for managers. A finance professor covered capital budgeting, explaining how to calculate the NPV and stating that it should be used to screen potential projects. In the Q\&A session, Ed Wilson, the treasurer of an electronics firm, said that his firm used the IRR primarily because the CFO and the directors understood the selection of projects based on their rates of return but didn't understand the NPV. Ed had tried to explain why the NPV was better, but he simply confused everyone, so the company stuck with the IRR. Now a meeting on the firm's capital budget is approaching, and Ed asked the professor for a simple way to explain why the NPV is better. The professor recommended the following extreme example. A firm with adequate access to capital and a 10% WACC is choosing between two (2) equally risky, mutually exclusive projects. Project Large calls for investing $100,000 and then receiving $50,000 per year for 10 years, while Project Small calls for investing $1 and receiving $0.60 per year for 10 years. Each project's NPV and IRR are shown in the table: The IRR says choose S, but the NPV says take L. Intuitively, it's evident that the firm would be better off choosing the large project despite its lower IRR. With a cost of capital of only 10%, a 49% rate of return on a $100,000 investment is more profitable than a 59% return on a $1 investment. When Ed gave this example in his firm's executive meeting on the capital budget, the CFO argued that this example was extreme and unrealistic and that no one would choose S despite its higher IRR. Ed agreed, but he asked the CFO where the line should be drawn between realistic and unrealistic examples. When Ed received no answer, he went on to say that (1) it's hard to draw this line and (2) the NPV is always better because it tells us how much value each project will add to the firm, and value is what the firm should maximize. The president was listening, and he declared Ed, the winner. The company switched from using IRR to NPV, and Ed is now the CFO. QUESTIONS: 1. Do you agree that the company should switch from IRR to NPV? 2. Why is NPV better than IRR in this scenario

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts