Question: With auto loans extending 5,6,7 or more years, it is common for buyers who wish to trade in their cars after a few years

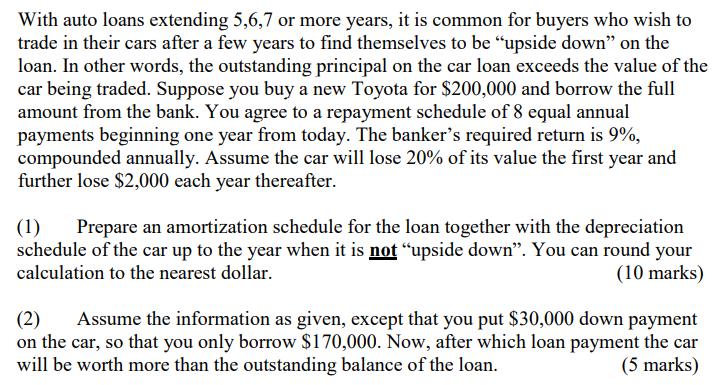

With auto loans extending 5,6,7 or more years, it is common for buyers who wish to trade in their cars after a few years to find themselves to be "upside down" on the loan. In other words, the outstanding principal on the car loan exceeds the value of the car being traded. Suppose you buy a new Toyota for $200,000 and borrow the full amount from the bank. You agree to a repayment schedule of 8 equal annual payments beginning one year from today. The banker's required return is 9%, compounded annually. Assume the car will lose 20% of its value the first year and further lose $2,000 each year thereafter. (1) Prepare an amortization schedule for the loan together with the depreciation schedule of the car up to the year when it is not "upside down". You can round your calculation to the nearest dollar. (10 marks) (2) Assume the information as given, except that you put $30,000 down payment on the car, so that you only borrow $170,000. Now, after which loan payment the car will be worth more than the outstanding balance of the loan. (5 marks)

Step by Step Solution

There are 3 Steps involved in it

To prepare the amortization schedule for the loan and the depreciation schedule of the car we need to calculate the annual payment amount the deprecia... View full answer

Get step-by-step solutions from verified subject matter experts