Question: WOM UU Question 3 lots 2 The table below provides the premiums for one year European options on an underlying asset with a current spot

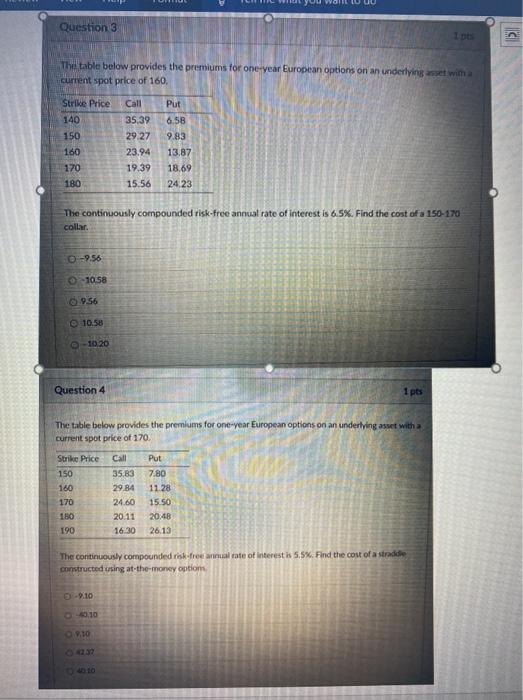

WOM UU Question 3 lots 2 The table below provides the premiums for one year European options on an underlying asset with a current spot price of 160 Call Strike Price 140 150 160 170 180 35.39 29 27 23.94 19.39 15.56 Put 6.58 9.83 13.87 18,69 24.23 The continuously compounded risk-free annual rate of interest is 6.5%. Find the cost of a 150-170 collar. 0 -9.56 10.58 0.9.56 10.58 - 10.20 Question 4 1 pts The table below provides the premiums for one-year European options on an underlying asset with a current spot price of 170 Strike Price 150 160 170 180 190 Call 35,83 29.84 24.60 20.11 16.30 Put 7.80 11.28 15.50 20:48 26.13 The continuously compounded risk free amal rate of interest is 5.5%. Find the cost of a straddle constructed using at the money option 09.10 12.10

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts