Question: Write a 400-500 word response providing 3 recommendations for how the business can improve in the next fiscal year based on the adjusted worksheet with

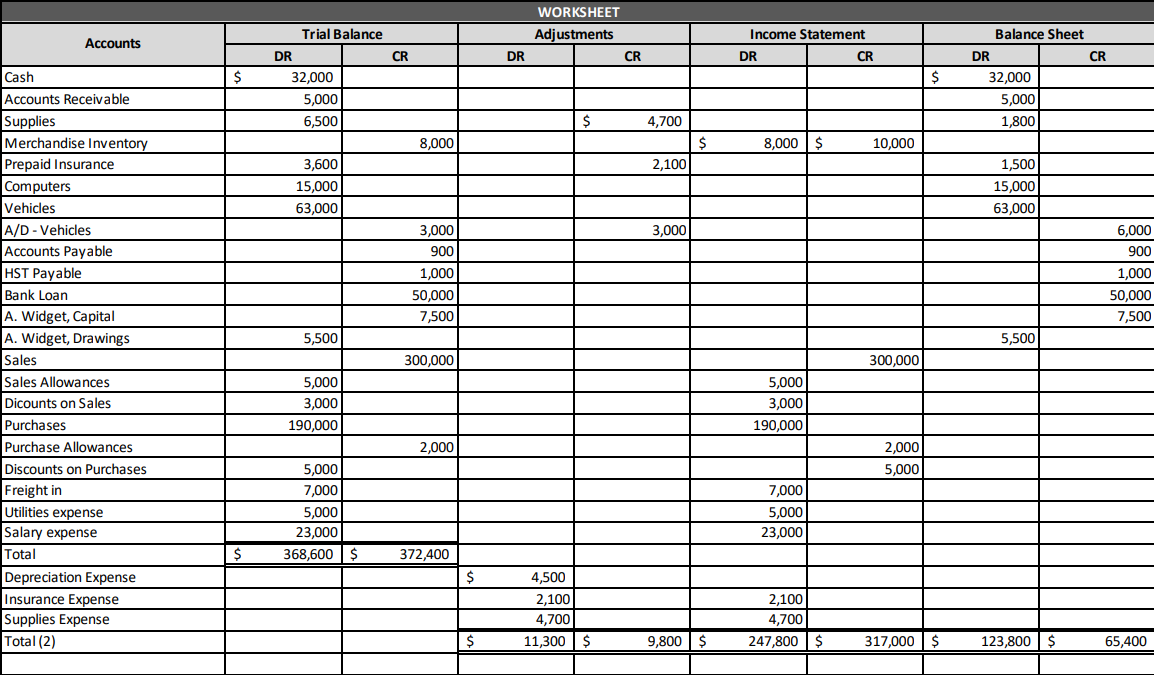

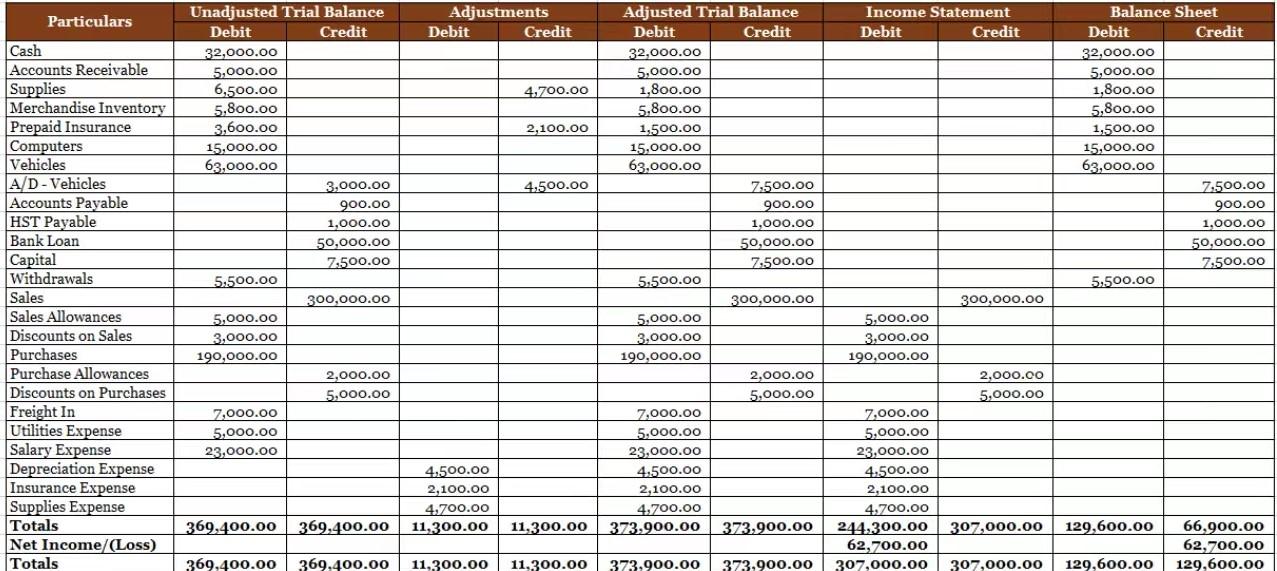

Write a 400-500 word response providing 3 recommendations for how the business can improve in the next fiscal year based on the adjusted worksheet with analyzing and explaining what impact each error has on understanding the profitability and success of the business. The first picture is the error one shows how did the adjustment work.

Accounts Cash Accounts Receivable Supplies Merchandise Inventory Prepaid Insurance Computers Vehicles A/D - Vehicles Accounts Payable HST Payable Bank Loan A. Widget, Capital A. Widget, Drawings Sales Sales Allowances Dicounts on Sales Purchases Purchase Allowances Discounts on Purchases Freight in Utilities expense Salary expense Total Depreciation Expense Insurance Expense Supplies Expense Total (2) $ $ DR Trial Balance 32,000 5,000 6,500 3,600 15,000 63,000 5,500 5,000 3,000 190,000 5,000 7,000 5,000 23,000 368,600 $ CR 8,000 3,000 900 1,000 50,000 7,500 300,000 2,000 372,400 $ $ DR WORKSHEET Adjustments $ 4,500 2,100 4,700 11,300 $ CR 4,700 2,100 3,000 $ 9,800 $ Income Statement DR CR 8,000 $ 5,000 3,000 190,000 7,000 5,000 23,000 2,100 4,700 247,800 $ $ 10,000 300,000 2,000 5,000 317,000 $ Balance Sheet CR 32,000 5,000 1,800 1,500 15,000 63,000 5,500 DR 123,800 $ 6,000 900 1,000 50,000 7,500 65,400 Particulars Cash Accounts Receivable Supplies Merchandise Inventory Prepaid Insurance Computers Vehicles A/D-Vehicles Accounts Payable HST Payable Bank Loan Capital Withdrawals Sales Sales Allowances Discounts on Sales Purchases Purchase Allowances Discounts on Purchases Freight In Utilities Expense Salary Expense Depreciation Expense Insurance Expense Supplies Expense Totals Net Income/(Loss) Totals Adjustments Debit Credit 4,700.00 2,100.00 4,500.00 Unadjusted Trial Balance Debit Credit Adjusted Trial Balance Debit Credit 32,000.00 32,000.00 5,000.00 5,000.00 6,500.00 1,800.00 5,800.00 5,800.00 3,600.00 1,500.00 15,000.00 15,000.00 63,000.00 63,000.00 7,500.00 3,000.00 900.00 1,000.00 900.00 1,000.00 50,000.00 7.500.00 50,000.00 7.500.00 5.500.00 5,500.00 300,000.00 300,000.00 300,000.00 5,000.00 5,000.00 5,000.00 3,000.00 3,000.00 3,000.00 190,000.00 190,000.00 190,000.00 2,000.00 2,000.00 5,000.00 2,000.00 5,000.00 5,000.00 7,000.00 7,000.00 5,000.00 5,000.00 23,000.00 23,000.00 4,500.00 7,000.00 5,000.00 23,000.00 4.500.00 2,100.00 4.500.00 2,100.00 4,700.00 2,100.00 4,700.00 4,700.00 369,400.00 369,400.00 11,300.00 11,300.00 373.900.00 373,900.00 244,300.00 307,000.00 129,600.00 62,700.00 369,400.00 369.400.00 11,300.00 11,300.00 373.900.00 373,900.00 307,000.00 307,000.00 129,600.00 Income Statement Debit Credit Balance Sheet Credit Debit 32,000.00 5,000.00 1,800.00 5,800.00 1,500.00 15,000.00 63,000.00 5,500.00 7,500.00 900.00 1,000.00 50,000.00 7,500.00 66,900.00 62,700.00 129,600.00 Accounts Cash Accounts Receivable Supplies Merchandise Inventory Prepaid Insurance Computers Vehicles A/D - Vehicles Accounts Payable HST Payable Bank Loan A. Widget, Capital A. Widget, Drawings Sales Sales Allowances Dicounts on Sales Purchases Purchase Allowances Discounts on Purchases Freight in Utilities expense Salary expense Total Depreciation Expense Insurance Expense Supplies Expense Total (2) $ $ DR Trial Balance 32,000 5,000 6,500 3,600 15,000 63,000 5,500 5,000 3,000 190,000 5,000 7,000 5,000 23,000 368,600 $ CR 8,000 3,000 900 1,000 50,000 7,500 300,000 2,000 372,400 $ $ DR WORKSHEET Adjustments $ 4,500 2,100 4,700 11,300 $ CR 4,700 2,100 3,000 $ 9,800 $ Income Statement DR CR 8,000 $ 5,000 3,000 190,000 7,000 5,000 23,000 2,100 4,700 247,800 $ $ 10,000 300,000 2,000 5,000 317,000 $ Balance Sheet CR 32,000 5,000 1,800 1,500 15,000 63,000 5,500 DR 123,800 $ 6,000 900 1,000 50,000 7,500 65,400 Particulars Cash Accounts Receivable Supplies Merchandise Inventory Prepaid Insurance Computers Vehicles A/D-Vehicles Accounts Payable HST Payable Bank Loan Capital Withdrawals Sales Sales Allowances Discounts on Sales Purchases Purchase Allowances Discounts on Purchases Freight In Utilities Expense Salary Expense Depreciation Expense Insurance Expense Supplies Expense Totals Net Income/(Loss) Totals Adjustments Debit Credit 4,700.00 2,100.00 4,500.00 Unadjusted Trial Balance Debit Credit Adjusted Trial Balance Debit Credit 32,000.00 32,000.00 5,000.00 5,000.00 6,500.00 1,800.00 5,800.00 5,800.00 3,600.00 1,500.00 15,000.00 15,000.00 63,000.00 63,000.00 7,500.00 3,000.00 900.00 1,000.00 900.00 1,000.00 50,000.00 7.500.00 50,000.00 7.500.00 5.500.00 5,500.00 300,000.00 300,000.00 300,000.00 5,000.00 5,000.00 5,000.00 3,000.00 3,000.00 3,000.00 190,000.00 190,000.00 190,000.00 2,000.00 2,000.00 5,000.00 2,000.00 5,000.00 5,000.00 7,000.00 7,000.00 5,000.00 5,000.00 23,000.00 23,000.00 4,500.00 7,000.00 5,000.00 23,000.00 4.500.00 2,100.00 4.500.00 2,100.00 4,700.00 2,100.00 4,700.00 4,700.00 369,400.00 369,400.00 11,300.00 11,300.00 373.900.00 373,900.00 244,300.00 307,000.00 129,600.00 62,700.00 369,400.00 369.400.00 11,300.00 11,300.00 373.900.00 373,900.00 307,000.00 307,000.00 129,600.00 Income Statement Debit Credit Balance Sheet Credit Debit 32,000.00 5,000.00 1,800.00 5,800.00 1,500.00 15,000.00 63,000.00 5,500.00 7,500.00 900.00 1,000.00 50,000.00 7,500.00 66,900.00 62,700.00 129,600.00

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts