Question: Write down an equation that relates the expected return of a stock Y, E[rY], to its systematic risk. b. Assume for the remainder of this

Write down an equation that relates the expected return of a stock Y, E[rY], to its systematic risk.

b. Assume for the remainder of this question that Ys beta is 1.3.

What is the expected return on Y?

c. Is it possible that another stock W has an expected return of 15% and a standard deviation of 24%? Why or why not?

d. Is it possible that a stock Z has an expected return of 10% and a standard deviation of 15%? Why or why not?

d. Is it possible that a stock Z has an expected return of 10% and a standard deviation of 15%? Why or why not?

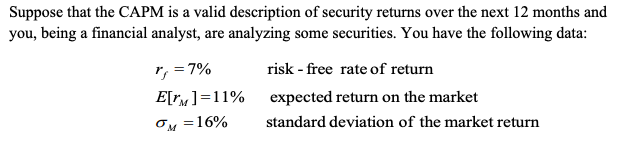

Suppose that the CAPM is a valid description of security returns over the next 12 months and you, being a financial analyst, are analyzing some securities. You have the following data: risk - free rate of return E[ru]=11% expected return on the market standard deviation of the market return r = 7% Om = 16% Suppose that the CAPM is a valid description of security returns over the next 12 months and you, being a financial analyst, are analyzing some securities. You have the following data: risk - free rate of return E[ru]=11% expected return on the market standard deviation of the market return r = 7% Om = 16%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts